Day 2 of the IFFO October Webinar looked at the demand side of the marine ingredients market and the latest in technical research from the industry. Presenters focused on how the markets have changed over the last year across multiple sectors, as well as certification and sustainability of ingredients.

Market Forum 2

Overview of global trends

IFFO’s Market Research Director Dr Enrico Bachis gave an overview of global market trends and consumers of fishmeal and fish oil.

IFFO’s Market Research Director Dr Enrico Bachis gave an overview of global market trends and consumers of fishmeal and fish oil.

Growth continues in Asia, especially China, now accounting for 85% of global fed aquaculture and crustaceans representing the biggest consumer of fishmeal.

There has been a rise in usage per sector for poultry and petfood, while inclusion rates in the pig sector were higher due to dietary changes in reaction to African swine fever. In terms of fish oil usage, salmonids are using 70% of fish oil that goes to aquaculture (mostly Europe and Latin America), but there is also usage in the Middle East with the marine fish of Turkey. Fish oil consumption by the petfood sector continues to rise with direct human consumption rates rising only slightly.

China update

Maggie Xu, Head of IFFO’s regional office in China, explained what the covid-19 pandemic has meant to China’s feed supply chain and how the industry keeps developing in the post-pandemic era.

Acceleration towards a domestic demand-driven model

China has accelerated its switch from an export-led model to a domestic demand-driven model, also known as dual-circulation development strategy.

According to cumulative 2020 data, fishmeal imported volumes remain below 2019 cumulative figures following both the Covid-19 pandemic and weather implications (floods in South China, temperatures, typhoons). Imported volumes from Peru have halved through August compared to 2019 whereas fish oil 2020 imports are slightly below the 2019 cumulative figures.

With covid-19 under control and recovery of animal farming (especially of pig farming, which might be endangered by a potential over-supply), China’s feed production has been surpassing last year’s production figures as of April 2020 according to the China Feed Industry Association. Volumes of pig feed outputs have been beyond the 2019 figures as of June 2020 whereas aquafeed output have been below 2019 figures since then.

Quality feed means quality fish in markets

As for China’s fishmeal and fish oil consumption, Xu emphasized the role of pig farming and aquaculture. The peak season for fishmeal consumption has proved disappointing so far but long-term growth is expected for premium aqua feed. According to 2019 data, fishmeal and fish oil feature high inclusion rates with seabass at 40-50% and 3-5% respectively, shrimp at 25% for fishmeal, eel at 65-68%, largemouth bass at 40-60% and snakehead at 25-30%.

Update on fish oil trade

Christian Meinich from Chr. Holtermann AS presented his latest insights on the supply and demand of both fish oil and EPA/DHA. For fish oil, prices have been variable but are currently around the 5-year average, reflecting a balanced market.

However, there is uncertainty around the upcoming season in Peru, the ongoing Covid-19 challenges, and finally the Brexit negotiations. Consumption from alternative sources of EPA/DHA such as algae-based products are steady after the rise in 2019, but there has not been growth since.

Aquafeed production has dropped in most areas in 2020 due to Covid-19 restritions, but some areas are seeing growth such as Norway. Another development that could affect consumption is the growth of land based salmon farming, which is slowly progressing with increasing number of projects, but it is not yet sizeable market. Finally, the continuing political uncertaintly with MSC blue whiting fisheries will have an affect on the markets, but this will hopefully be resolved.

Latest trends within the feed sector

Moving to feed, Morten Holdorff Møjbæk from BioMar presented the latest news from this important sector. The opportunity and challenges for aquaculture are well known and create a large platform for future investments into the sector. Aquaculture production is predicted to double from 2010 to 2050 and Møjbæk stated that this could be done without taking one more fish from the ocean, or using any more agriculture land for crops. Aquafeed is responsible for up to 80% of the environmental footprint of producing seafood. He noted that the absolute volumes of marine raw materials used has remained the same over the last 30 years, with inclusion rates dropping to allow for growth.

The raw material basket for aquafeed is constantly evolving to allow for growth, with an increase use of vegetable proteins, by-products, ingredients from low trophic levels and single cell proteins. Møjbæk added that ingredients from low trophic levels enable the use of new species, reducing both energy loss and the use of dioxins, but further development, especially regulatory, is needed here. Marine raw materials will continue to be used as they are great sources of nutrients, but they must continue to be sustainably sourced to ensure consumer trust in the end product.

Technical Forum

Sustainability was again at the centre of discussions in the Technical Forum.

IFFO Consultant Neil Auchterlonie opened up proceedings with the latest on IFFO’s technical projects from around the world. He then handed the floor to MarinTrust CEO Francisco Aldon, who presented the Chain of Custody certification and the Marine Ingredient value chain. Moving back to sustainability, Dr Christopher M. Free (University of California-Santa Barbara) looked at how demands of the growing seafood industry can be met through sustainable aquaculture growth.

Sustainability and biodiversity of ingredients

Dr Christopher M. Free’s presentation looked at projected global population growth and the limited opportunity for land-based growth but large opportunities for growth in sustainable mariculture, which is the cultivation of marine organisms in their natural habitats. Free highlighted the pathways for growth as improving governance to ensure sustainable practices, easing regulatory barriers, and streamlining permitting. He noted that through technological innovations in production efficiency the ocean could grow the ocean could produce 36% more food in 2050 than today, with the greatest growth in mariculture (12% growth).

Dr Christopher M. Free’s presentation looked at projected global population growth and the limited opportunity for land-based growth but large opportunities for growth in sustainable mariculture, which is the cultivation of marine organisms in their natural habitats. Free highlighted the pathways for growth as improving governance to ensure sustainable practices, easing regulatory barriers, and streamlining permitting. He noted that through technological innovations in production efficiency the ocean could grow the ocean could produce 36% more food in 2050 than today, with the greatest growth in mariculture (12% growth).

In terms of ingredients, Free highlighted the increased ecological pressures of increasing plant based products and the trade-offs need to be evaluated.

The complex issue of measuring and comparing biodiversity and land-use impacts of ingredients is also being analysed in an upcoming IFFO funded paper. Auchterlonie noted that this paper looks at the impacts on biodiversity if marine protein production had to be replaced with terrestrial crops.

Regulatory updates on antioxidants and dioxins

Auchterlonie presented the latest regulatory developments for Ethoxiquin and Butylated Hydroxytoluene (BHT), which are both within a reauthorisation process by the European Food Safety Authority (ESFA). Decisions on both are expected in 2021 and 2022. For Dioxins, the European Commission is currently revising maximum limits (MLs) on products including fishmeal and fish oil.

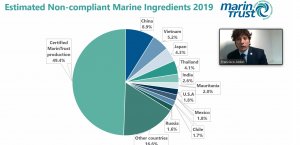

Certification of marine ingredients

Francisco Aldon presented the latest news on the MarinTrust Chain of Custody certification and the Marine Ingredients value chain. MarinTrust currently certifies 49% of fishmeal and fish oil produced globally and due to COVID 19 restrictions the standard is currently operating under an extraordinary event procedure, which includes remote audits. MarinTrust Chain of Custody (CoC) standards protect against the use of false claims by providing assurances along the value chain to the origin and integrity of the certified material. CoC V2.0 comes into effect from 30th November 2020 and maintains the assurance of all products under the MarinTrust brand, including the Improver Programme, throughout the different steps within the supply chain. The MarinTrust Improver Programme is the only programme that allows a Fishery Improvement Project (FIP) to have a claim for the marine ingredients up to the feed producer. Finally, to ensure a fully integrated value chain, MarinTrust are taking into the consideration the requirements of relevant standards such as BAP, Global GAP and ASC.

Francisco Aldon presented the latest news on the MarinTrust Chain of Custody certification and the Marine Ingredients value chain. MarinTrust currently certifies 49% of fishmeal and fish oil produced globally and due to COVID 19 restrictions the standard is currently operating under an extraordinary event procedure, which includes remote audits. MarinTrust Chain of Custody (CoC) standards protect against the use of false claims by providing assurances along the value chain to the origin and integrity of the certified material. CoC V2.0 comes into effect from 30th November 2020 and maintains the assurance of all products under the MarinTrust brand, including the Improver Programme, throughout the different steps within the supply chain. The MarinTrust Improver Programme is the only programme that allows a Fishery Improvement Project (FIP) to have a claim for the marine ingredients up to the feed producer. Finally, to ensure a fully integrated value chain, MarinTrust are taking into the consideration the requirements of relevant standards such as BAP, Global GAP and ASC.

Conclusions

Concluding the whole webinar, IFFO’s Director General said he takes pride in being part of a very exciting sector: “Exciting because it bears a huge responsibility: feeding a growing population. Dr Christopher Free’s presentation underlined large opportunities for growth in sustainable mariculture. This has just been echoed by Morten from Biomar, who stressed the low environmental impacts of fish. Exciting also because it is constantly adapting to new circumstances” he said.

Johannessen echoed yesterday’s panel discussion: adaptation is part of the industry’s way to operate on a daily basis and this will continue, in order to take climate change implications into account. He also referred to Neil Auchterlonie’s presentations, stressing current regulations challenges, regarding antioxidant uses and upcoming decisions from the EU. Johannessen argued that the industry is also adapting to resources availability. Marine resources are constantly fluctuating – this is a natural process.

Johannessen then expressed his satisfaction at seeing the science and the industry working hand in hand. “The science is clearly providing clear guidance to the industry about fishery management and fish stocks assessment” he said, adding that nutrition is also a much needed science. “The current reduction of EPA/DHA shouldn’t be overlooked. Farmers don’t want to decrease this any further”, he said.

To finish with, Johannessen argued that voluntary certification standards are proving efficient. “The industry is very proud to have developed a voluntary certification standard for marine ingredients, which is run within an independent third party programme, MarinTrust. This is clearly a market driven approach which wouldn’t exist without the industry’s inputs and commitment” he said. Certification programmes are now delving into blockchain technologies in order to track products back to their origin, especially byproducts, which is key for the future.