This piece authored by Dr Brett Glencross was originally published in International Aquafeed magazine, February 2024 edition

There is a growing intensity in the search for more circular feed ingredients around the world now. Millions of dollars/euros/pounds are being spent on developing technologies for insect farming, single-cell proteins (SCP), and algal oils. The logic behind this for the most part seems sound; generation of new feed resources; reduction of pressure on existing resources by better utilising those already available. The sort of stuff that has made sense for years really. So why is it seen as so “niche” and “novel” now? And how well is this novel stuff progressing, what “circular ingredients” are actually out there?

Getting reliable data on the volumes of products like insect meal and single-cell proteins has been a game of guess works for some time now. Rabobank in 2021 estimated insect meal production was only 10,000 tonnes. Even the most bullish estimates did not have that more than doubling each year since, so in 2025 that might at best be no more than 100,000 tonnes. Single-cell protein production seems even further behind. With estimates of production by industry front-runner Calysta predicting no more than 20,000 tonnes, and other players substantially further behind. So, SCP… maybe 30,000 tonnes at best by 2025. Algal oil, another strong emerger has estimates of only 40 to 50,000 tonnes from two companies. So, combined we see in 2025 a field of around 180,000 tonnes at best.

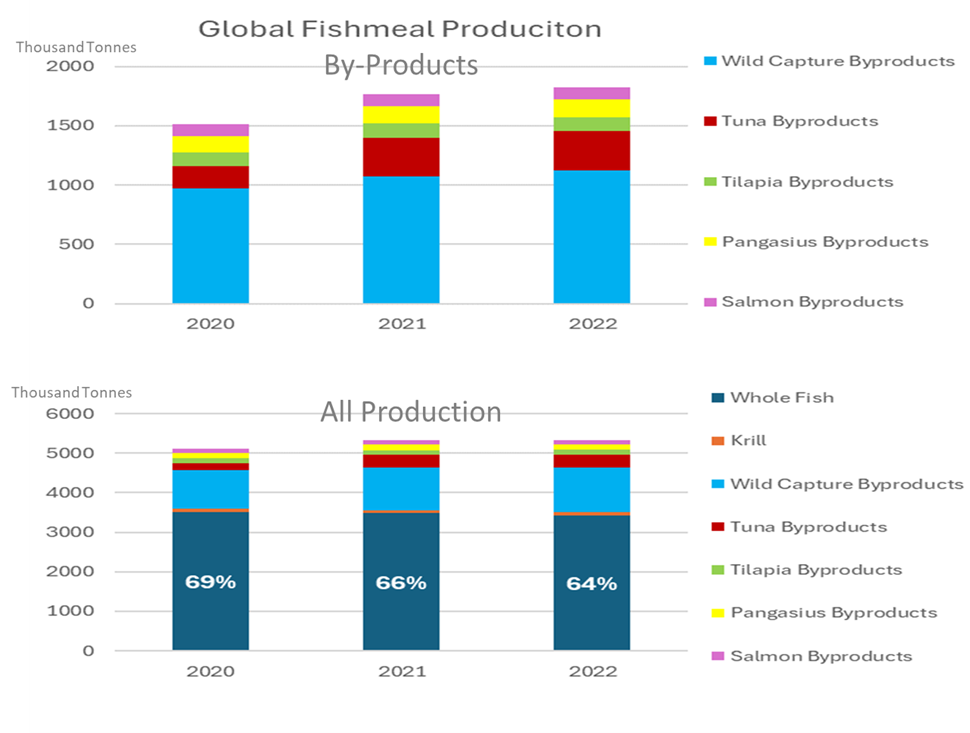

Another circular ingredient that seems to go under the radar though is marine ingredients produced from by-products. Recent estimates released by IFFO indicate that almost 40% of the raw material used for marine ingredient production now comes from by-products sources of fish processed for human consumption. When we analyse this separately as fishmeal and fish oil, we see that the global production of fishmeal from by-products accounts for around 35% in 2022 (Figure 1), while fish oil production from by-products represented 54% of the total fish oil production in 2022. This amounts to a massive 1.8 million tonnes of by-product fishmeal in 2022, and 692 thousand tonnes of fish oil, for a total of 2.517 million tonnes of marine ingredients from by-products.

Indeed, so valuable now are marine ingredients that some fishing vessels are now being equipped to preserve or process by-products on board into fishmeal and oil. Increasingly we are also seeing onshore processing facilities improving their collection methods to ensure that marine ingredient processors have a reliable supply of quality by-products. More and more large aquaculture operators are constructing facilities that preserve and process by-product raw material into fishmeal and oil. This is particularly the case for farmed Atlantic salmon, pangasius and tilapia, which are each emerging as major suppliers of raw material for marine ingredients into the future.

Despite huge progress in recent years, more is still needed to further capture the full potential impact and scale of available circular marine ingredients in an economically feasible way while maintaining quality and safety standards. So, irrespective of what “niche” and “novel” products appear to be emerging, in the background marine ingredients continue to grow at a pace faster than both insects and SCP combined. So, it begs the question are we really still searching for circularity, or has it never really been forgotten?

Figure 1