With a growing population and a growing middle class, all feed ingredients are needed to produce more aquafeeds (from 60 million today to 70 million by 2025) and support the growth of the aquaculture sector.

This is what Dr Enrico Bachis demonstrated during an UndercurrentNews webinar on 8 July 2021, where he represented the marine ingredients industry during a panel discussion which featured Louis Rens, former commercial vice president of the Peruvian fishmeal producer TASA, Dr Dominique Bureau, professor of animal nutrition and aquaculture at the University of Guelph and Prof. Kevin Fitzsimmons, Professor at the University of Arizona.

Price volatility

As with any other natural feed ingredient, fishmeal and fish oil are highly dependent on climate conditions. Changes in the weather regime can affect, positively or negatively, the supply of all natural ingredients, and in turn alter their equilibrium price. This is what causes price volatility, a common feature of all feed ingredients.

In addition, market forces naturally cause price inflation over a long period of time for those goods with tight margins and robust demand. This is the case of all natural feed ingredients, whose nominal prices have grown over time.

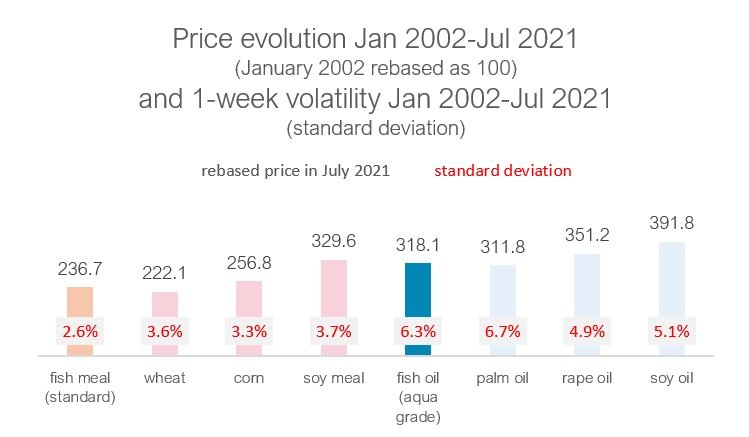

The following graph shows the price evolution over the last 20 years, by rebasing the price in January 2002 as 100 and reporting what is the corresponding price nowadays. All ingredients reveal inflationary trends, and thus fishmeal and fish oil.

The graph also estimates the price volatility (commonly measured by the Standard Deviation) over the same period of time, showing that fluctuations around the mean price are inherent to all natural ingredients.

Combining stability in volumes and high nutritional profile

Fishmeal and fish oil are one of the key components of aquafeeds because they provide the strategic assurance that farmed fish are given the nutrients that they need. Feed producers stick to marine ingredients not only because of the unmatched nutritional properties that marine ingredients provide in a single package, but also because producers value the stable volumes that have been offered over the last ten years: one million metric tons of fish oil and five million metric tons of fishmeal on average.

Responsible sourcing and production

The market increasingly demands sustainability credentials regarding responsible sourcing and production. Already 50% of the global supply is certified against the MarinTrust standard.

The MarinTrust standard assures that marine ingredients are sourced in fisheries championing best practices, such as effective fishery management, including monitoring and enforcement. Vessels must also comply with national regulations. Plants must also comply with all their national environmental regulations in relation to emissions to air, discharge to water, noise, smell, dust and ground pollution. The MarinTrust standard is underpinned by conventions set by the International Labour Organisation and the plant must comply with their country’s social regulations.

For the parts of the world which are not in this 50%, fishery improvement projects provide a path towards improved fisheries management and rely on collective work with local stakeholders within governments, businesses and local populations, alongside international organisations.

An example of this is the amazing progress made by the industry in Thailand through their commitment to the improvement journey as part of the MarinTrust Improver Programme.

One of the key drivers for increased sustainability is also the use of trimmings, which result from fish processing. Bachis estimates that currently thirty per cent of the global supply of fish meat and fish oil are produced with by-products. Technologies used to recover those raw materials and improve their yields are developing. By 2030, thirty-five per cent of the global supply is expected to come from by-products according to the FAO. This is promising: in Vietnam for instance, where the use of by-products is less well known, fifty percent of the fishmeal comes from by-products and ninety per cent of the fish oil comes from by-products.

New horizons

Change may also arise through additional raw materials such as krill and mesopelagics. Practices within the krill industry, where the total allowable krill catch is limited to less than 1% of the stock biomass, are a good example of what could be achieved with mesopelagics.