IFFO’s 8th China Summit took place on 19th -20th June in Foshan city, China, with 148 delegates from 18 countries. IFFO’s China Director Maggie Xu opened the event by introducing the speakers and topics covered, starting with a global tour of marine ingredient markets, with IFFO’s Market Research Director Enrico Bachis setting the scene on global market with a special focus on Asia. Market updates were also provided on Peru, Chile, Thailand, and the USA before an update from GOED on global omega-3 supply and ending with a focus on fishmeal and fish oil demand in China.

Marine ingredients production in Asia

IFFO’s Enrico Bachis presented an analysis of 2024 production data from Asia and globally, noting that global supply of fishmeal and fish oil has remained consistent with average levels seen over the past decade. Asian countries provide between 30% to 35% of the fishmeal and fish oil produced worldwide, with growing intra-trade within the Asian region. In terms of raw material sourcing, by-products remain the key source in Asia, especially for fish oil production. Bachis underscored the differences between Asia's and particularly China's production and consumption patterns compared to global trends, emphasizing how Asian nations will continue relying on international trade to meet their domestic needs for fishmeal and fish oil. He also highlighted the industry's resilience in the face of significant environmental challenges.

Favourable conditions in Peru in 2025

Presenting an update on the Peru marine ingredients supply and demand, Didier Saplana, COO at Austral Group, opened by stating that Peru has registered a strong recovery in 2024, with landings reaching 4.7 million tons and a fishmeal production exceeding 1 million tons. The anchovy fishery is based on scientific management and a system of individual quotas allowing the preservation of an average healthy biomass of 9.2 million tons over the last 15 years.

Saplana noted that the industry has worked hard to reduce by-catch, which is well below the 5% annual limit, with 100% of the capture being landed and online control by Produce, ensuring a stable biomass. Favorable oceanographic conditions in the first semester of 2025 indicate a positive continuation in terms of an abundance and availability of anchovy during the 1st fishing season in the Center/North of Peru.

Imarpe, the Peruvian maritime institute in charge of monitoring the anchovy, has assessed a biomass of 10,92 million tons, an increase of 10% compared to the same period last year, allowing the Ministry of Production to set a 3 million quota. He concluded by adding that the start of the first fishing season 2025 confirmed the availability of anchovy, as the Peruvian fleet captured 50% of the quota within the first 30 days, enabling an ample supply of fishmeal and fish oil to all markets; and that 70% of the quota has been fulfilled by the day of this event.

Chilean production and industry developments

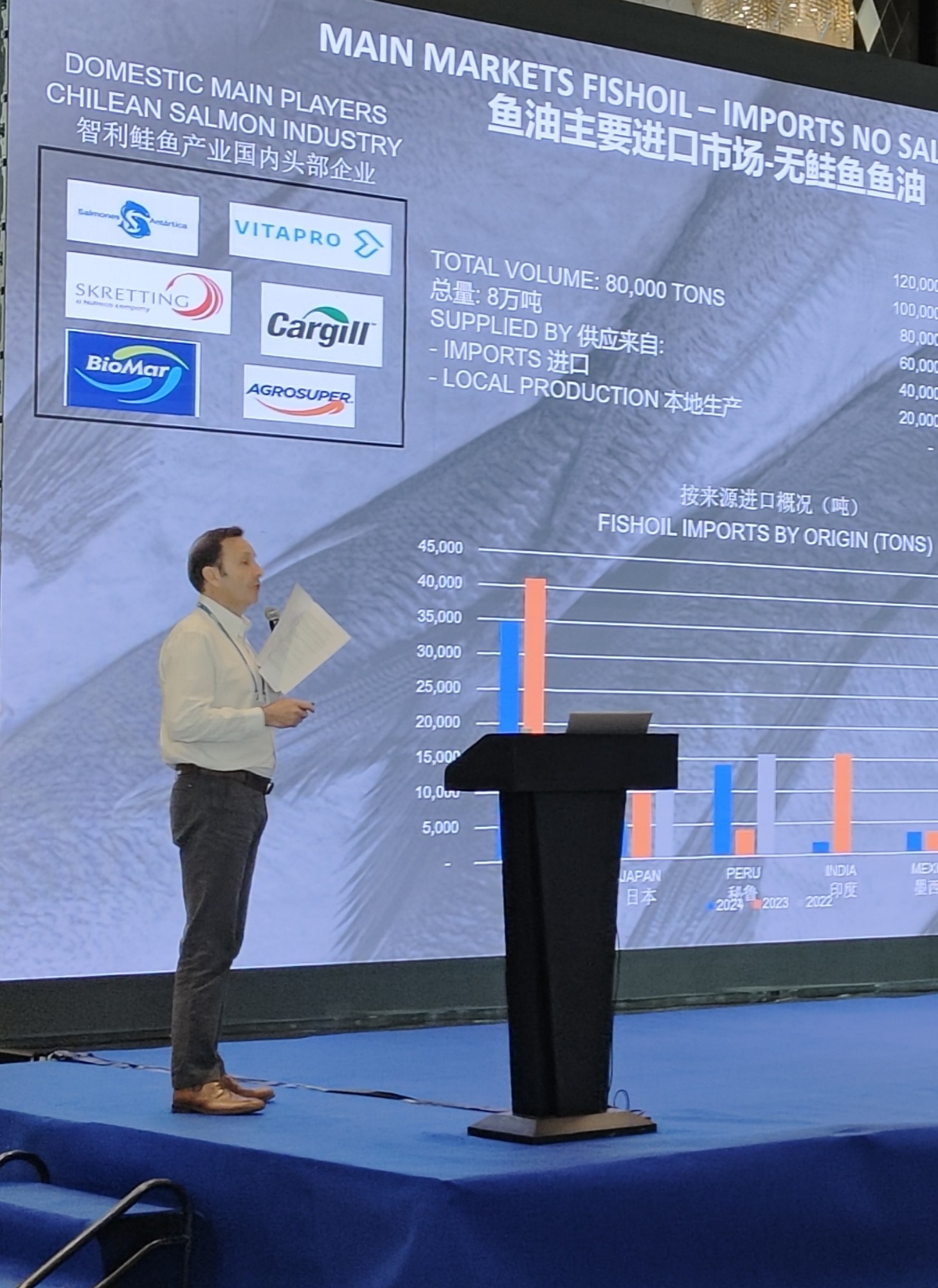

Presenting an update on Chile, Jorge Bernales, the Commercial Director Fishing Division of Camanchaca S.A., spoke at the summit. Bernales mapped out the regulation and sustainability management structure in Chile, noting that the industry is regulated by the Chilean Sanitary Authority, Sernapesca, who manages annual quotas for each species, with Individual Transferable Quotas (ITQs) to prevent overfishing, and has real-time closures when juvenile fish are detected. The impacts of climate change are causing concerns for jack mackerel and sardine-anchovy stocks, with lower catches during El Niño years. He added that the industry is shifting towards sustainability and certification to meet EU and US market standards.

Presenting an update on Chile, Jorge Bernales, the Commercial Director Fishing Division of Camanchaca S.A., spoke at the summit. Bernales mapped out the regulation and sustainability management structure in Chile, noting that the industry is regulated by the Chilean Sanitary Authority, Sernapesca, who manages annual quotas for each species, with Individual Transferable Quotas (ITQs) to prevent overfishing, and has real-time closures when juvenile fish are detected. The impacts of climate change are causing concerns for jack mackerel and sardine-anchovy stocks, with lower catches during El Niño years. He added that the industry is shifting towards sustainability and certification to meet EU and US market standards.

Bernales presented an update on Chile’s marine ingredient supply and demand, noting that landings were up by 53% in 2024 from 2023 due impacts from El Niño, and landings in 2025 are higher, with a total quota of 710,000 tons. China and Southeast Asia (70%) are the main export markets for small pelagics fishmeal, followed by Japan and South Korea(20%), and exports to Europe (7%) in 2024. For fish oil, Europe remains the dominant market (83%), followed by China and Southeast Asia (14%) in 2024.

Thailand's Fishmeal Industry

Moving to Thailand Kittipat Oerareemitr, Director of Thai Fishmeal Producers Association and Fishmeal Marketing Development, gave an update from Thailand’s largest fishmeal company. Introducing the industry, he noted that the Thai Fishmeal industry has evolved a great deal over the last 40 years. 14 facilities are certified under the MarinTrust programme (Main Factory Standard and Chain of Custody Standard), ensuring responsible sourcing, traceability and production, and four factories are accepted in the MarinTrust Improver programme as being part of a Fishery Improvement Project (FIP).

“55% of the catch from the sea is for the human consumption, and about 30 to 35% is for the low value fish, which can go to both industry, which is fish soluble paste, and fishmeal industry” he noted." By-products contributes 58% of Thailand’s fishmeal production.

We believe sustainability and stability are the true treasures we can leave for future generations," he said. "To meet global demands, we must continuously reform, such as with Fishery Improvement Projects (FIPs). This vision reflects Thailand’s proactive stance in aligning with international sustainability standards while maintaining its competitive edge in Asia’s fishmeal trade.”

USA Fishmeal Supply 2025

Providing an update on US fishmeal supply, Jostein Rortveit, Director of American Seafood, noting that USA supply of fishmeal is mainly expected to be stable in 2025 compared to 2024. Alaska Pollock quota was up about 5% in 2025, while Hake was down 26%, with Rortveit adding that all though fishing for hake in 2024 was poor. Menhaden quota in Atlantic is stable and fishing volume in the Gulf is expected be stable in 2025.

Rortveit summarised that while China historically is an important market, the demand for white fishmeal is good in all markets in 2025 due to good catches of elver / baby eel in early 2025. In the USA, the domestic market uses white fishmeal predominantly for petfood, due to fishmeal’s good nutritional profile and palatability. Fishing in Alaska during A-season in 2025 was normal and finished in early April. B-season starts in June and would end by September or October at the latest if fishing is as usual. Hake fishing is normally concentrated in May and September and October. In 2024, the hake fishing was poor, and quota reduced, and we will see how it goes for 2025.

Omega-3 market developments

GOED’s Managing Director Ellen Schutt then provided an overview of the EPA and DHA omega-3 market for the human nutrition space, including omega-3 applications. The uses of omega-3 in human nutrition are diverse, and include dietary supplements, pharmaceuticals, clinical nutrition, infant formula and food/beverage applications. Omega-3 volume is expected to grow by 5% per year, with growth highest in the petfood and infant formula sectors. However, diversity of sources is very important, particularly given the supply chain challenges in 2023. Schutt presented some key issues impacting the market, such as China’s proposed fish oil standard (with ban above 70% concentration) and formulation changes. Regarding tariffs, Schutt said that while they remain a concern, it is currently unclear whether they will impact demand.

China’s aquaculture and fishmeal markets

Moving back to China, Zhaogang Jiang, President of Evergreen International Trade, presented an update on the demand trends for fishmeal and chicken meal in China's aquafeed sector. Meanwhile, focusing on Evergreen's industrial structure of "six fishes, three shrimps, and one frog", his presentation delved into the special aquaculture models and their development trends in the ready-to-cook food industry, along with the company’s move to expand their global presence.

Regarding China fishery output, Jiang noted that output in 2023 was 71.16 million MT, including marine, freshwater aquaculture and captures. Freshwater farmed fish species are both rich and diverse and the past decade the China Fishery Statistical Yearbook has documented 25 farmed species. Among these, six species have an annual production exceeding one million MT, including carp (multiple varieties), and tilapia. Additionally, there are 11 species with annual outputs ranging between 100,000 MT and 1 million MT, including Wuchang bream, snakehead, largemouth black bass, and a variety of catfish and eel. Regarding farmed shrimp, Jiang noted that there has been much volatility and change in this sector. Finally, marine fish farming has a rich diversity of species in China with production over the last decade of large yellow croaker, seabass, grouper, and seabream has grown rapidly.

Regarding China fishery output, Jiang noted that output in 2023 was 71.16 million MT, including marine, freshwater aquaculture and captures. Freshwater farmed fish species are both rich and diverse and the past decade the China Fishery Statistical Yearbook has documented 25 farmed species. Among these, six species have an annual production exceeding one million MT, including carp (multiple varieties), and tilapia. Additionally, there are 11 species with annual outputs ranging between 100,000 MT and 1 million MT, including Wuchang bream, snakehead, largemouth black bass, and a variety of catfish and eel. Regarding farmed shrimp, Jiang noted that there has been much volatility and change in this sector. Finally, marine fish farming has a rich diversity of species in China with production over the last decade of large yellow croaker, seabass, grouper, and seabream has grown rapidly.

Regarding fishmeal, China is one of the largest consumer, with 2-2.5 million MT. 1.9 million MT of fishmeal imported in 2024 and 2 million MT is expected to be imported in 2025, predominantly from Peru and Chile. Jiang added that domestic fishmeal output is 400,000-600,000 mt annually, mainly from wild captures along the coastline and by-products from processing. The use of chicken meal in aquafeed production is growing, with chicken meal production rising 10% annually to 600,000-700,000 mt per year. Recent tariffs are expected to decrease imports from the USA, further driving domestic growth of chicken meal.

China’s booming fish oil market

The final speaker was Kevin Ransbotyn, General Manager of Alliance Nutrition Group, who provided an analysis of the expanding omega-3 sector in China, highlighting key trends, consumer behaviours, and business opportunities. Starting with Pet nutrition, Ransbotyn summarised that China’s pet care market, valued at $41.7 billion (2024), allocates 52.8% of expenditure to pet food, with omega-3 products gaining traction. The pet fish oil segment is projected to grow to $134 million by 2025, driven by demand for skin, coat, and joint health solutions. Ransbotyn also quoted a survey showing that more than 94% of pet owners are willing to pay for pet nutrition including fish oil.

Growth is also increasing in dietary supplements, with domestic health food market reaching $73 million (2024), and omega-3 supplements leading e-commerce growth at 26% YoY. Government initiatives like Healthy China 2030 and an aging population (3 billion seniors by 2025) are further propelling demand. In the e-commerce market in 2024, fish oil products had growth rate as high as 26% in the first quarter, ranking first in the nutritional and healthy products and keeping growing in the past 12 months. This demand is driving innovation, focusing on concentration, oxidation stability and enhanced bioavailability, catering to premiumization trends.

Looking ahead

During the fruitful discussion after the presentations, Didier Saplana added that he is optimistic about the climatic and oceanographic conditions in Peru, and it is likely that the fishing quota of 900,000 tons will be fished. In terms of challenges facing the industry, both Enrico Bachis and Ellen Schutt noted that additional feed ingredients can help meet the growing demand for EPA and DHA. However, production has increased in 2024 and Zhaogang Jiang added that a 20% of increase for fishmeal consumption in feed was expected in 2025 in China. From last year, he said, China's fishmeal consumption is growing, despite the declining demand, which means that the leading production companies are using more fishmeal in feed recipes to improve performance. In Chile, Jorge Bernales noted that there is a consumption change with jack mackerel in Chile, with more going to direct human consumption for its high nutritional value, reducing the production of fishmeal for the eel market.