The second day of IFFO’s Annual Conference featured presentations and discussions on the feed ingredients ecosystem. The session started with a focus on global grains and oil seed markets with Oscar Tjakra, Executive Director of RaboResearch Food and Agribusiness. Tjakra presented the complex trade dynamics and strategic priorities facing the value chain amid ongoing geopolitical tensions; with key features influencing future supply including weather variability, uneven population growth, and evolving biofuel and decarbonization policies.

The US trade tariffs have impacted the markets, for example by increasing soybean oil prices in the US, with record investment in U.S. crushing assets-over and they remain more competitive then other markets. Brazil’s soybean supply is expected to increase and there has again been more investment in crushing assets, with corn consumption also increasing due to ethanol production. Weather conditions are showing a weaker La Nina over the next few months, so shouldn’t greatly impact harvests, soybean plantings in South America are progressing well.

Globally Tjakra noted that 2025/26 wheat, corn and soybeans production is expected to increase year-on-year, and while China’s soybean imports are also increasing year-on-year, they are not buying from the US market which will reduce prices there. Global supplies of grains and oilseeds (G&O) are expected to remain ample through the remainder of 2025, likely keeping prices within expected ranges. Tjakra concluded that as we enter a period of geopolitical uncertainty and protectionism, trade rules are adding costs and complications which drives reactionary growth in new markets. He added that “global grain and oil trades are like water, if something gets in its way, it finds a new way.” At a farm level, Tjarkra noted that there are continuing consolidation trends, with focus on increasing efficiency and investment in new technology.

Climate impacts on global fisheries

Continuing with long-term impacts, Dr. Christopher Free, Assistant Researcher at the University of California – Santa Barbara, presented his latest research on the impacts of climate change on global forage fish fisheries. He noted that while, on a whole, small pelagic stocks will likely reduce, by around 5% depending on global GHG emissions, the impacts are less with the small migratory fish species than with higher trophic species. Fish stocks will likely continue to shift polewards to track cooler water, such as with West African forage fish moving northward.

However, winds have intensified in most upwelling systems over the past 60 years, and while global Earth System Models predict reduced winds and upwelling intensity, local predictions remain unclear and could have a greater impact. An example of this unpredictability can be seen with the unprecedented suppression of Panama Current upwelling in 2025 due to reduced winds. Another example of misunderstood climate impacts has been seen with Pacific Sardine recruitment, which was thought to be high in warm years, and yet the population collapsed during a heatwave in 2015.

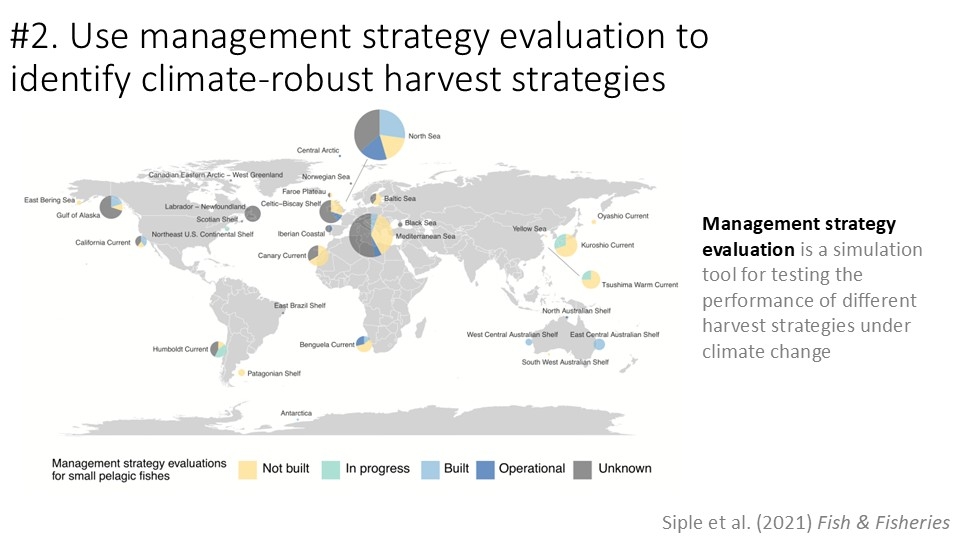

Free’s recommendation for how the industry can respond to this uncertainty was first to end overfishing to increase profits and resilience. Free recommended the use of management strategy evaluations to identify climate-robust harvest strategies and prepare for shifting stocks. Free concluded that "this industry has a pivotal role in food security over the next century, you are at the forefront of ensuring sustainable growth and can adapt to these climatic changes".

Update on single-cell proteins

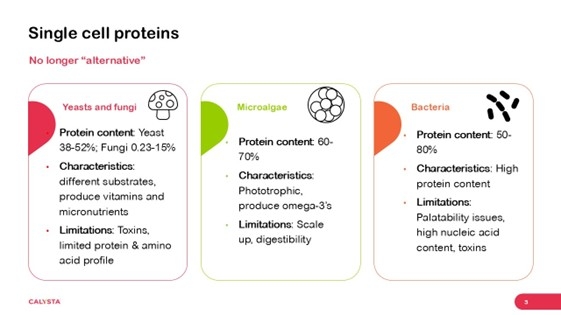

Looking at emerging feed ingredients, Matt Longshaw, Research and Application Manager at Calysta, provided an update on single-cell protein (SCP) production (sources from yeast/fungi, microalgae and bacteria), focusing on the commercial entities that are working at pilot and at scale up. Longshaw noted that SCPs have unique profiles and uses. They have good nutritional characteristics, are highly digestible and have led to positive growth outcomes in many instances, but if you don’t get the growth intake right you can lower both feed intake and impair overall health.

As with many of these emerging ingredients, results in aquafeed have been mixed. Longshaw noted that single-cell protein production is not at scale (yet), and due to its lower value in the aquaculture market we have seen a shift in focus to livestock, pet and human food applications, especially in Europe. “Most people in reality have not gone beyond lab testing. Getting at scale is not an easy game”. Production and development have not been simple, from being very expensive to build and run, to encountering new regulatory rules for novel proteins, and investor pressures for short term results. Longshaw stated that “five years ago, it was relatively easy to get money. With recent failures, funding support is much more difficult to find and investors want their money back within a short time frame”. Expertise in these areas is very limited, this is compounded with the feed vs food conflict and increasingly complex sustainability measures. However, Calysta is enjoying first mover advantage and they have good partnerships and funding.

Longshaw concluded “that while these proteins are not intended to replace more traditional protein sources, they are expected to support the wider ingredients industry by providing additional functional benefits alongside more traditional protein sources.”

(Oscar Tjakra, Dr. Christopher Free and Matt Longshaw)

Panel discussions: The feed ingredient ecosystem

The session ended with a panel discussion featuring the morning’s speakers alongside IFFO’s Technical Brett Glencross and Global Seafood Journalist Drew Cherry.

Oscar Tjakra, Executive Director at RaboResearch Food and Agribusiness, opened the conversation by addressing the evolving landscape of grains and oilseeds. He emphasized the enduring dominance of corn in global agriculture: “Corn will remain the king, but crop rotation is needed.” Tjakra also highlighted the critical role of government subsidies in the viability of biodiesel and renewable energy production. Notably, he pointed out that subsidy reductions in the U.S. are shrinking margins, which could dampen demand. However, he remained optimistic about future trends, predicting that “in the next five years, demand is expected to continue to increase, especially in the west coast states of the US. Vegetable oil is going to get costly.”

Chris Free from the University of California described a two-phase shift: “We’ll see gradual change until 2050, and then strong change.” Free emphasized the importance of adaptability, urging the industry to “diversify the portfolio of fish species that are targeted and utilised,” and to reconsider facility locations based on emerging climate science. He also warned of physiological changes in marine life, stating, “Fish will get smaller in the future. Their oxygen demand will increase, while oceans will hold less oxygen as they get warmer.” He advocated for closer collaboration between scientists and fishermen to develop “early warning indicators” and improve gear and catch limit management.

Brett Glencross, representing IFFO, described fishermen as “the first sentinels” of environmental change. He noted that “certain areas are more sensitive than others,” citing the Peruvian coast as a relatively stable zone. Glencross praised the fishing sector’s proactive stance, particularly in adopting certification standards, and posed a challenge to policymakers: “How can government facilitate and step up?” He also delved into sustainability metrics, arguing that “Life Cycle Assessment is a better alternative” to the old sustainability metrics like FI:FO or FCRs because of its holistic approach. There is an opportunity for certification programmes to embed LCA in their process. He stressed the importance of objectivity in sustainability narratives: “There’s the sustainability story and then there’s reality.” Glencross highlighted the disparity in sustainability demands across sectors, noting, “European and North American markets are sensitive to sustainability credentials,” especially in high-value segments like salmon and shrimp. He pointed out that “MarinTrust certifications cover almost 50% of global marine ingredients production,” but lamented that the role of fish byproducts remains underappreciated: “The annual growth we are seeing in byproduct fishmeal alone is greater than that of insect meal, algal oil and single cell proteins combined.” He called for better communication about marine ingredients’ role in global food systems: “Objectivity will always trump subjectivity, and the EU’s CSRD is a big opportunity.”

Matt Longshaw of Calysta insisted that “innovation cannot be done with goodwill and promises. Investment is needed, and we are talking of hundreds of millions of USD.” Longshaw explained the cost dynamics of scaling up, noting, “Talking about novel proteins at a pilot scale is incredibly expensive. At full scale, when the system is running 100% of the time, those costs come down quite rapidly.” He predicted market consolidation, saying, “Smaller numbers of players will be seen in the future,” and highlighted the progress in the algal oil and yeast sectors, and then ultimately bacteria.

Throughout the discussion, the panelists underscored the need for realism, collaboration, and innovation in addressing the intertwined challenges of sustainability, climate change, and food security.

Side event: Feed, Aquaculture, and Future: Dialogue on Marine Industry & Sustainability in Japan

Hosted by Kanematsu

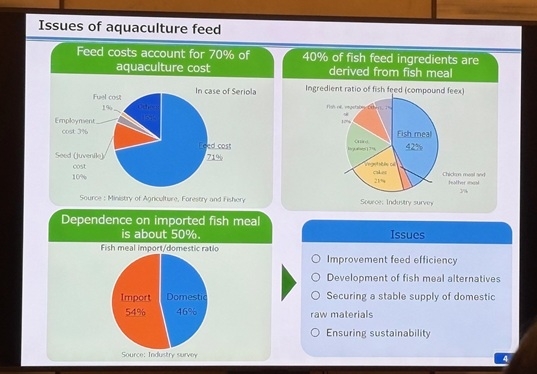

At this side event, Wataru Tanoue, representing the Fishery agency of Japan, introduced the audience to Japan's aquaculture strategy. He underlined that Japan is shifting to market oriented aquaculture and working to enhance cooperation, coloration across the aquaculture value chain. The Japanese government has set very ambitious targets and is working to meet the gap between current production volumes. Feed costs account for 70% of aquaculture costs and 40% of fish feed ingredients are derived from fishmeal, with dependence on 50% of imported fishmeal. Government budgets have been increased to improve feed efficiency, development fishmeal alternatives and other technologies. With an already high proportion of by-products being used (69%), and highly complex networks of fish processing across the country, Japanese culture is already built on waste reduction. Safety inspections are being increased to further increase the accessibility of by-products. Certification is already high across the country, with MSC, ASC and MEL (Japan). Land based aquaculture has also increased, with main species being shrimp, seaweed and abalone, and mostly small scale producers. New land-based salmon farms are in operation or being constructed. Japan is trying to expand production volume, increasing fish feed availability and making the most of the fishmeal that is available.