IFFO held a Vietnam webinar on 14 July 2021. Below are some key takeaways.

Opening Remarks

Petter M. Johannessen, Director General, IFFO

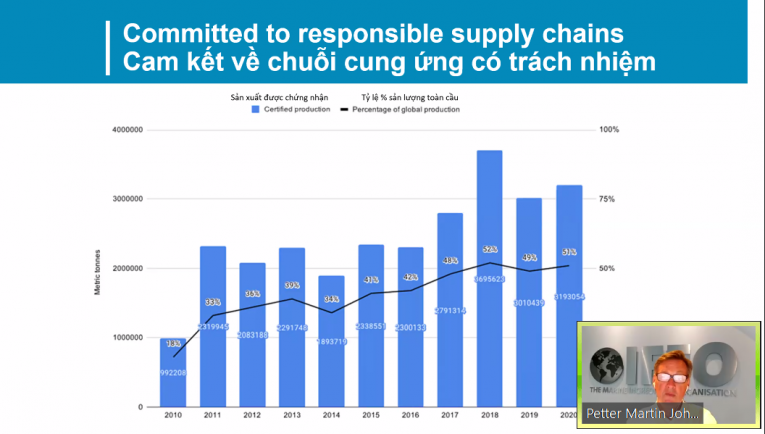

With over 60 years of representing the marine ingredients industry, IFFO’s members account for 55% of global production and 75% of sector traded value. While supporting its members with a wide range of benefits, one of IFFO’s main focuses is to further the responsible sourcing and production of marine ingredients. Demand for marine ingredients remains high and to ensure the industry’s viable and sustainable future, a chain of industry standards now offer full traceability from fishery to consumer. Globally over half of the world’s marine ingredients are responsibly produced and marine ingredients remain the aquaculture industry’s leading certified raw material.

With over 60 years of representing the marine ingredients industry, IFFO’s members account for 55% of global production and 75% of sector traded value. While supporting its members with a wide range of benefits, one of IFFO’s main focuses is to further the responsible sourcing and production of marine ingredients. Demand for marine ingredients remains high and to ensure the industry’s viable and sustainable future, a chain of industry standards now offer full traceability from fishery to consumer. Globally over half of the world’s marine ingredients are responsibly produced and marine ingredients remain the aquaculture industry’s leading certified raw material.

The industry’s value chain and chain of custody allows producers of marine ingredients and their customers to demonstrate robust traceability at every stage. Through working with our members, standards and partners IFFO is working to strengthen the global standing of the industry, while supporting responsible supply worldwide. Each stage of the chain is covered by relevant checks and certifications, which are putting in place recognition procedures among each other to ensure smooth collaboration and flow of the products.

Planning marine aquaculture in Vietnam

Luan Tran Dinh

Dr Luan, Director General of the Directorate of Fisheries at the Ministry of Agriculture and Rural Development, Vietnam, delivered a key note speech presenting Viet Nam’s assets in terms of fisheries and outlining Vietnam’s policies for developing marine aquaculture. “This industry is becoming a major component of Vietnam’s marine economy” he stated.

The target for marine aquaculture in Vietnam in 2030 is 1,450,000 MT, in which: coastal aquaculture: 1,110,000 MT; offshore aquaculture: 340,000 MT, he explained. The 2030 target for export turnover from marine aquaculture is 3-4 billion USD.

With a coastline of 3,260km, the total potential area for marine aquaculture amounts to 500,000 ha, in which 153,300 ha of tidal areas. The country has 79,790 ha of lagoons, bays and island waters and 100,000 ha of offshore waters.

A wide range of species are used for marine aquaculture, from marine fishes (grouper, cobia, red snapper, sea bass, seabream, yellowfin pompano, tuna, milkfish) to mollusc (clams, oysters, green mussels, otter shells, abalones, pearl mussels, sweet snails), crustaceans (lobsters, crabs, swimming crabs) and seaweeds. There are 7.5 million m3 of cages, producing 610,000 MT in 2020. Total marine aquaculture area in 2010 was 38,800 ha; by 2019 it reached 256,479 ha with average growth rate of 23.3%/year.

As the aquaculture plan have just been submitted to the Vietnamese Prime Minister, Dr Luan highlighted the main areas of focus. While research on seed production technology for some marine fishes as well as for commercial grow-out of several mollusc species has been completed, there is a need to dive deeper into some key topics such as:

- seed production for other species: giant grouper, slipper lobster, algae, etc.;

- floating HDPE cages;

- the manufacturing of feed for lobsters. Research on feed for yellowfin pompano, grouper, seabass and cobia has already been successfully completed.

Key orientations for the future are the development of marine aquaculture for both aquatic fauna and flora species, focusing on increasing productivity, quality, and economic efficiency, protecting the ecological environment and adapting to climate change. Dr Luan also underlined a strong willingness to develop marine aquaculture associated with innovation and re-organization of production, building cross-cutting value chains for each product group, in which industrial mariculture enterprises are a key element in the Scheme for Marine Aquaculture Development.

Marine ingredients: an overview of the latest trends

Dr Enrico Bachis, Market Research Director, IFFO, U.K.

With 81 countries across the world producing fishmeal, 73 exporting fishmeal, and 89 importing it, this is a truly international market. The fish oil industry shares the same features, with 70 countries producing fish oil, 80 exporting it and 98 importing it. Latin America (with Peru and Chile) are leading the world's fishmeal production, followed by South East Asia. Latin America and Asia are big fish oil producers as well, but Europe and USA play a slightly bigger role than in fishmeal's world production. Yield (ie, which depends on how much fat can be extracted from the species) is a key factor to explain the difference.

Fishmeal is by far mostly imported by Asia, with China playing a massive role, followed by Europe, mostly for the aquaculture industry, whereas fish oil's biggest importers are in Europe (54%) followed by Asia and Latin America.

This difference can be explained through inclusion rates of fish oil in the diet of farmed fish. 5Mt FM and 1.2Mt FO were produced globally in 2020 and a stable output is expected for 2021. Today, most of the fishmeal and fish oil are consumed by the aquaculture sector. However, in Asia, the role of aquaculture is lower because of inclusion rates, while the pig industry is a bigger consumer of marine ingredients.

Dr Bachis underlined that agri-commodities are natural ingredients whose availability depends on climate. This explains price volatility : while fishmeal has been stable over the last 12 months, other commodities such as corn, soya meal have been less stable.

Fishmeal application to feed in Vietnam

Michael Leger, Technical Manager and Yosuke Sakurai, Procurement & Purchasing Manager / Lead Buyer Marine Ingredients Asia, Skretting South-Asia

Skretting, established in 1899, operates production facilities in various countries across all the Continents. As a Global Feed Company, total usage of Ingredients are significant and influential to both Environment and Society. Developing sustainable solutions to address a limited supply of ingredients is part of the Skretting mission "feeding the future".” More and more responsible sourcing is therefore important and Global Procurement network strives for it.

Skretting Global Procurement network is designed to create maximum Value by frequent and close collaboration. Skretting Vietnam produces Starter, Grower and Functional Feeds for several fish and shrimp species. These diets were designed thanks to a strong focus on R&D at the global level.

Skretting Aquaculture Research Center, through its network or research and validation facilities, works on developing nutritional and health solutions. By improving the knowledge on the nutritional requirements and understanding better the quality and the digestibility of the ingredients, Skretting can deliver performing diets while optimizing the use of fish meals and oils.

GSA program and aquaculture and trade in Vietnam

Nguyen Thi Thanh Binh, Viet Nam Country Coordinator, GSA, Vietnam

The Global Seafood Alliance – formerly the Global Aquaculture Alliance – is an independent, not-for-profit organization. The GSA vision is to provide high quality, end-to-end, fully traceable assurance for seafood, supporting the sustainable development of global production while protecting people and planet. GSA works with partners where standards already exist and creates transparent and credible standards to fill gaps where needed. The organization’s work addresses the full spectrum of responsibility, from environmental responsibility and social accountability to food safety.

Through the development of its Best Aquaculture Practices (BAP) and Best Seafood Practices (BSP) certification programs, GSA has become the leading provider of assurances for seafood globally. BAP is the well-known, unique aquaculture certification program in the world that certifies every step of the production chain. BSP is the world’s only third-party certification program capable of linking responsible fisheries to certified vessels and processing plants. BSP is also the only program that can reduce time and costs of linking together other certification programs that only cover a fraction of what is covered under BSP.

Vietnam is among the top aquaculture production and export countries globally. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam's aquaculture production sharply increased (about 11 times), from 415 thousand tons to nearly 4.6 million tons with annual growth rate of 10%. Aquaculture has accounted for 54% of total seafood production in Vietnam within the last 15 years (from 1995 to 2020). The main farm raised species are brackish cultured shrimps (Vannamei and Monodon) and Pangasius, followed by several fresh water and marine farmed species.

The primary Vietnamese exported aquaculture products are shrimps and pangasius. From 1998-2020, Vietnam’s shrimp exports increased more than 8 times, from $457 millions to $3.73 billions with annual growth rate of 10%. Shrimp accounted for the highest percentage, highest growth and consistently proved to be the most stable of the Vietnamese aquaculture exports. Pangasius exports increased 162 times, from $9.3 millions to $1.5 billion with annual growth rate of 26%.

Vietnam exports seafood to more than 160 markets around the world. The top 4 Vietnamese exports markets include USA, EU, Japan and China. On March 11. 2021, the Prime Minister confirmed Decision No. 339/QD-TTg and thereby, the Vietnamese Fisheries Development Strategy to 2030. This strategy targets aquaculture production of 7.0 million tons and accounts for 70% of the country’s total seafood production. To achieve this 2030 target, the Vietnam’s aquaculture industry will need to adopt responsibly raised international standards such as BAP standards.

Supply chain in Vietnam and sustainability

Nguyen Nam Hai, Sub-manager, Kanematsu, Vietnam

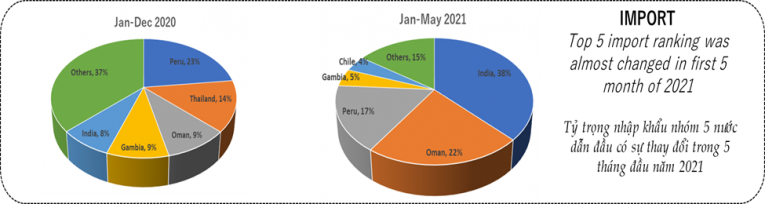

Starting with the Vietnam import markets, Nam Hai noted that in 2020, Vietnam imported 200,000 tons of fishmeal, making is one of the largest importers in Asia, due to the competitive prices and shorter transit time from Asia origin such as India and Oman. Ranking of top 5 origin is shown in the chart below, the first five months of 2021 shows a complete change in the top 5 origin and ranking order.

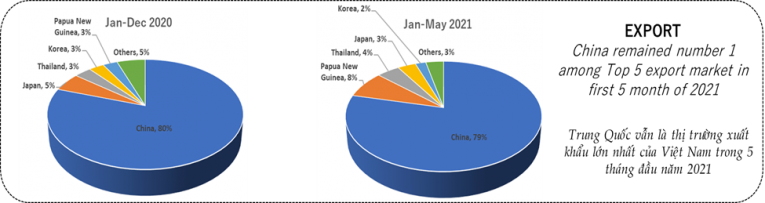

While for export picture, in 2020 Vietnam exported 150,000 tons of fishmeal (from 300,000 tons local production). Top 5 export market ranking is shown below, with China remaining in top position throughout the years. The reason why China keeps importing Pangasius fish meal is due to its advantages such as: low TVN (freshness), short transit time, stable supply, sustainability, and traceability.

Imported volume is forecasted to be dropped to 150,000 tons in 2021, and 160,000 tons in 2022. By contrast, exported volume will increase to 180,000 tons in 2021 (from 301,000 tons of local production), and 190,000 tons in 2022 (from 298,000 tons of local production).

Besides fishmeal, fish oil is an important part in aquatic and shrimp feed. In 2020, Vietnam imported 17,000 tons fish oil, in which Chilean and Norwegian salmon fish oils are major suppliers that can cover from 55% to 65% total demand. The reason why customers prefer this supply source is because they can get MarinTrust approved material at a competitive price, with stable supply and good quality. If customers choose supply source with higher total omega 3, Japanese, Oman, Pakistani and Thailand sardine fish oils could be considered, which currently contribute 20% - 25% total import volume.

Meanwhile, in the same year Vietnam exported 83,000 tons fish oil mainly Pangasius fish oil (from 167,000 tons local production). The biggest export market is Singapore, which is being served for Bio – Fuel. Imported volume is forecasted to be sustained 17,000 tons in 2021, and 18,000 tons in 2022. While exported volume will also maintain 84,000 tons in 2021 (from 175,000 tons of local production), and 84,000 tons in 2022 (from 177,000 tons of local production).

Regarding fishmeal and fish oil import regulations, new parameters listed include Arsenic, Cadmium, Lead, Mercury and Ethoxyquin for fishmeal; as well as Arsenic, Ethoxyquin and free of E.Coli and Salmonella for fish oil.

China market access especially MOARA license

Xiaowen Ling, IFFO Technical Specialist, IFFO, China

Xiaowen Ling, Technical specialist at IFFO China office will provide a comprehensive overview of China import regulations. She will summarize the government authorities, regulations and standards related to China Import, explain the conditions to export fishmeal/fish oil into China, and provide a short introduction on IFFO MOA licensing application assistance service to non IFFO members. In the past 10 years, IFFO China office has been offering a Licensing Application Assistance Service, covering new license application, license renewal and license alteration, to IFFO producer members. The success rate is 100%, with 289 licenses granted by MOARA to the clients from 15 countries, and the market share in license application service accounts for almost 30%. From this year, IFFO opens this service to the producers who are not IFFO members.

Fishmeal imports and application to feed in China

Vinh Binh Hau, Purchase Manager, Tongwei, Vietnam

Covering an overview of Vietnamese fishmeal and its export to the China market. In Vietnam, fishmeal is mostly produced from small raw fish species and the catch varies along the coastline. The main type of raw fish are anchovy, sardine, yellow scrap, splendid pony fish and short-finned saury; with anchovy providing the highest raw material (65-67% protein).

The North and South of Vietnam have different fishing seasons due to the climate, affecting both supply and quality of fishmeal. Pangasius fishmeal has 25% protein, and is the most competitive product as the local climate is suited to farming this species. It is a successful raw material export to around the world, including to the US, EU, Russia and South Africa. In the immediate future, with the farming scale exceeding 1,500,000 tons, Vietnam's pangasius fillet industry has ensured an abundant source of raw materials for the production of pangasius fishmeal and fish oil. Pangasius fishmeal production is about 150,000-170,000 tons. Fish oil production is about 170,000-210,000 tons. It is a fresh source of raw material with short transportation, especially to China, which ensures the quality of product. Largest exports are to China and other South East Asian countries, while 50-60% is consumed domestically. The fish are larger in central and North Vietnam and therefore produce fish oil, while in the south the fish are smaller so not able to produce fish oil.

Since 2014, Vietnam's fishmeal production has been stably maintained at nearly 3,100,000 tons, which is the highest production of fishmeal ever. After verifying the import and export data of Vietnam's fishmeal, it’s shown that the consumption of Vietnamese domestic fishmeal is gradually increasing.

From 2014, production is stable with an increasing trend, with the highest production of 3,100,00 tons. Consumption of domestic fishmeal is increasing, and export to China is stable and regardless of climate change or the COVID 19 pandemic, but price is impacted by the foreign exchange market.

In terms of quality and use, Vietnamese fishmeal has a similar level of amino acids to Thai and Mauritanian fishmeal, ash level is usually higher than Chinese fishmeal with the same protein level. In conclusion, the market is expected to grow with the only potential impact of future fishing limits.

Panel discussion

A panel discussion followed individual presentations, with all speakers invited to answer questions from the audience and from Maggie Xu, FFO’s China Director, who moderated the discussion. It focused on sustainability, fishmeal quality and output in Vietnam and the impacts of Covid19.

Responsible sourcing and production

Emphasizing that certification standards are key to demonstrate sustainability in the marine ingredients sector in the long term, Petter Johannessen, IFFO’s Director General, underlined that above 51% of all marine ingredients are certified by MarinTrust, with no other aquafeed ingredient having reached this level. The main driver is the industry with a growing market demand.

International trade and Covid impacts

Vietnam is one of the key countries in our sector, explained Dr Enrico Bachis, IFFO’s Market research Director: top 5 in production and top 10 in consumption. The feed production industry is massive: it was worth 1billion USD last year. Regarding fish oil, there is huge potential for Pangasius oil, given its sustainable sources and potential as a cooking product. Binh Hau from GSA, added that Vietnam currently has a very strong position in global trade, especially for shrimp and pangasius. Shrimp exports to the EU has reduced in recent years but the Vietnam/EU free trade agreement will hopefully help exports grow, he mentioned.

How has COVID 19 affected trade in Vietnam? Nam Hai from Kanematsu explained that the virus has spread in south Vietnam and there are social restrictions in place. There is concern about supply of fish oil and fishmeal decreasing because of this.

Binh Hau from GSA added that a number of factories have been closed because of COVID 19 and both demand and consumption is expected to decrease. Social distancing and safety measures have been introduced to reduce infections.

Fishmeal quality and procurement

Dr Brett Glencross, IFFO’s Technical Director, gave a quick overview of quality parameters of fishmeal produced across the region. “Even amongst the difference in species, there has been a drive to reduce the variability. But these products are different and they do focus on different markets. Producers have got better at controlling the quality of products and what is the best markets for their use” he stated.

Addressing challenges in procuring fishmeal, Yosuke Sakurai from Skretting South East Asia explained that there are a lot of parameters to meet, such as ash, protein, palatability etc. “Best of the requirements, we then have to find the best match for specific feeds to ensure quality.” Michael Leger, his colleague at Skretting, added that strong cooperation between technical and purchasing departments was needed. “There are many quality parameters but sustainability and food safety are the most important points to notes. Regarding nutrition that is just matching up the requirements for each species.”

To finish with China’s requirements for fish oil for feed and food, IFFO’s Xiaowen Ling made it clear that the MOA license is for feed, whereas the producers need to apply for GAC lists as well when it comes to food.

Closing Remarks

Maggie Xu, China Director, IFFO

This webinar has given us a chance to delve into global fishmeal and fish oil market dynamics, Vietnam feed production, marine ingredients trade, aquatic product output and trade as well as Vietnamese fishmeal consumption in China. IFFO recognises Vietnam’s key role in the global marine ingredients and aquaculture industries and we look forward to continuing our work in this region following these fascinating discussions. Both access and sustainability remain at the core to the long-term success of this industry.