12th December 2023

IFFO - The Marine Ingredients Organisation held a one-day workshop in Guangzhou, China and explored the value points and global market dynamics of marine ingredients from both a Chinese and global perspective. The event gathered 69 representatives of the industry, mostly based in China.

Maximising the use of fishmeal instead of substituting

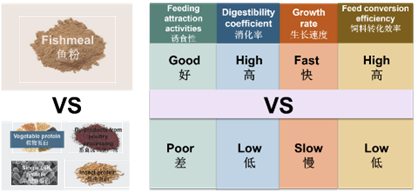

Looking at the feed challenges facing the aquaculture industry, Prof./Dr. He Gen, from the Ocean University of China noted that fishmeal, as main protein source of aquaculture feed, has unparalleled advantages over other raw materials in terms of feed conversion efficiency. His latest report deconstructs fishmeal and analyses its use as high-quality protein source with essential nutrients such as taurine, hydroxyproline and vitamin D3. The inclusion of fishmeal also impacts the relationship between amino acid balance and nutrition sensing and metabolism of fishes. Through systemic analysis and comparison, Dr He noted that fishmeal substitution is the underlying cause for poor animal growth and feed ratio. Strategic use of fishmeal through precision nutrition is the key to success.

Looking at the feed challenges facing the aquaculture industry, Prof./Dr. He Gen, from the Ocean University of China noted that fishmeal, as main protein source of aquaculture feed, has unparalleled advantages over other raw materials in terms of feed conversion efficiency. His latest report deconstructs fishmeal and analyses its use as high-quality protein source with essential nutrients such as taurine, hydroxyproline and vitamin D3. The inclusion of fishmeal also impacts the relationship between amino acid balance and nutrition sensing and metabolism of fishes. Through systemic analysis and comparison, Dr He noted that fishmeal substitution is the underlying cause for poor animal growth and feed ratio. Strategic use of fishmeal through precision nutrition is the key to success.

The key role played by fishmeal in shrimp feed

The benefits of fishmeal were echoed by Prof./Dr. Niu Jin from Sun Yat-sen University discussing the technical development of high-efficiency feed for shrimp. In China, the shrimp industry accounts for 27% of fishmeal consumption. In 2022, fishmeal imports were 1.8 Mt and with the increasingly severe situation of being highly dependent upon imports and continued price rises, the development of a new protein source and fishmeal alternative has become the industry consensus. However, fishmeal, as one best feed protein source, has balanced amino acid composition and proportion and rich fatty acid especially including the highly unsaturated fatty acid required for aquaculture animals. The fishmeal substitution is not the simple substitution by other proteins but the effective compatibility substitution of compound protein. Therefore, substituting fishmeal in high levels will impact the growth and physiological metabolism of aquaculture animals.

“Under the current market condition, the primary concern of aquaculture practitioners is how to maximize the application value of fishmeal instead of simple study of fishmeal alternatives”, Niu insisted. At present, the unique function of fishmeal cannot be replaced by other substances, so it is necessary to maximize its function potential, such as with fishmeal phosphorus, fishmeal polyunsaturated fatty acids, fishmeal trimethylamine N-oxide and other unknown trophic factors. The low-level fishmeal feed formula shall contain “functional additives” to eliminate the bad impact of fishmeal substitution and maximize the potential value of fishmeal.

Sustainable use of fish oil in aquatic feed

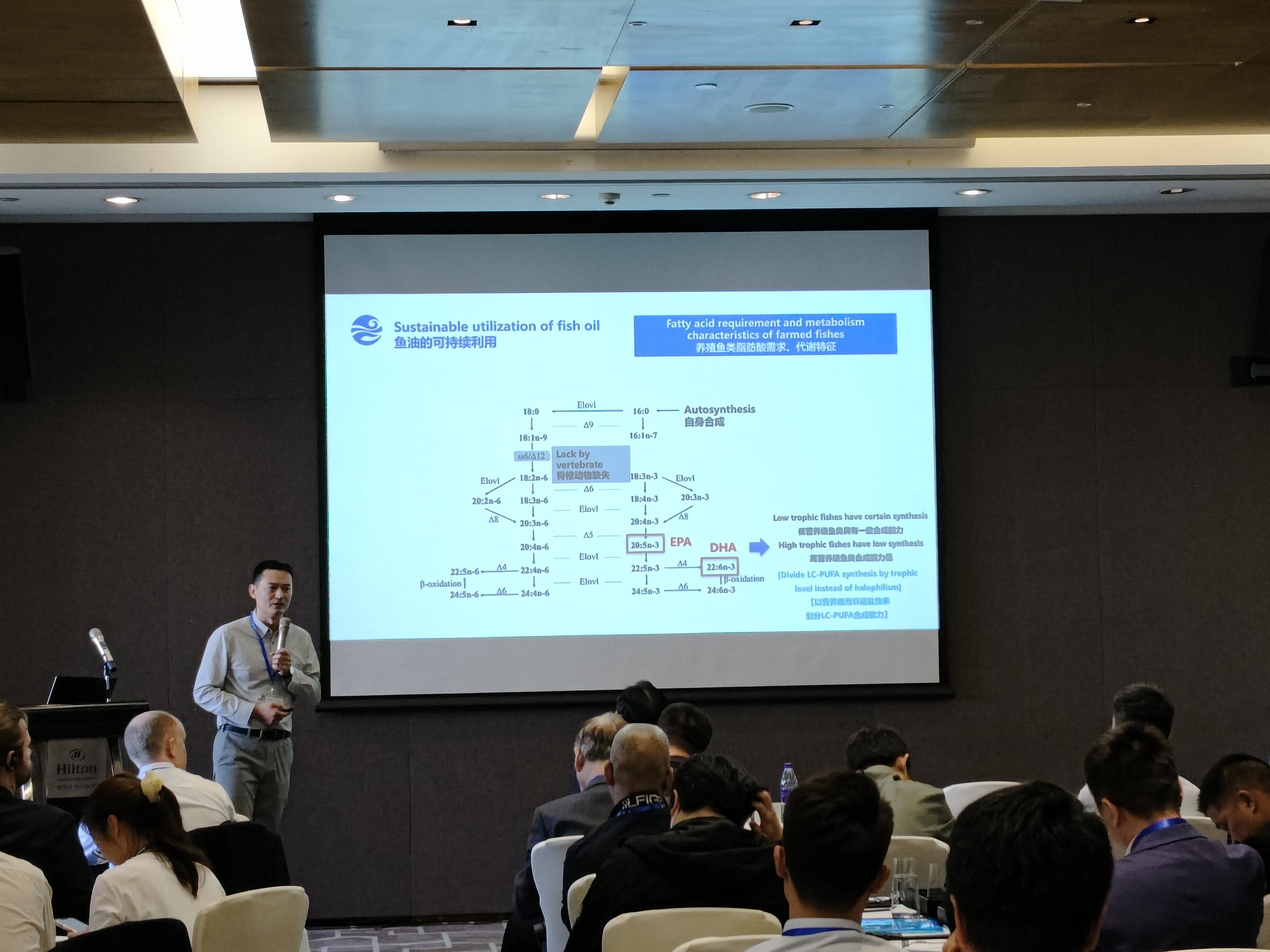

Moving to fish oil in aquafeed, Dr. Xu Houguo, from the Yellow Sea Fisheries Research Institute at the Chinese Academy of Fishery Sciences, noted that like fishmeal, fish oil is also a strategic resource in short supply and this shortage has become a major challenge in the aquaculture feed industry. High-quality fish oil in particular is in short supply and China has always relied on imports, which are subject to supply fluctuation, so it is urgent to improve the utilization efficiency of fish oil. For this purpose, it is necessary to start with its many uses, starting by clarifying the optimal requirement of different aquaculture animals for long-chain polyunsaturated fatty acids including DHA and EPA and the metabolic characteristics of its fatty acid. Secondly, Dr Xu noted that a reasonable fish oil alternative strategy needs to be developed in combination with fish oil finishing, alternated feeding and other feeding strategies to ensure no effect on the growth of aquaculture animals and the nutritional quality of fatty acid.

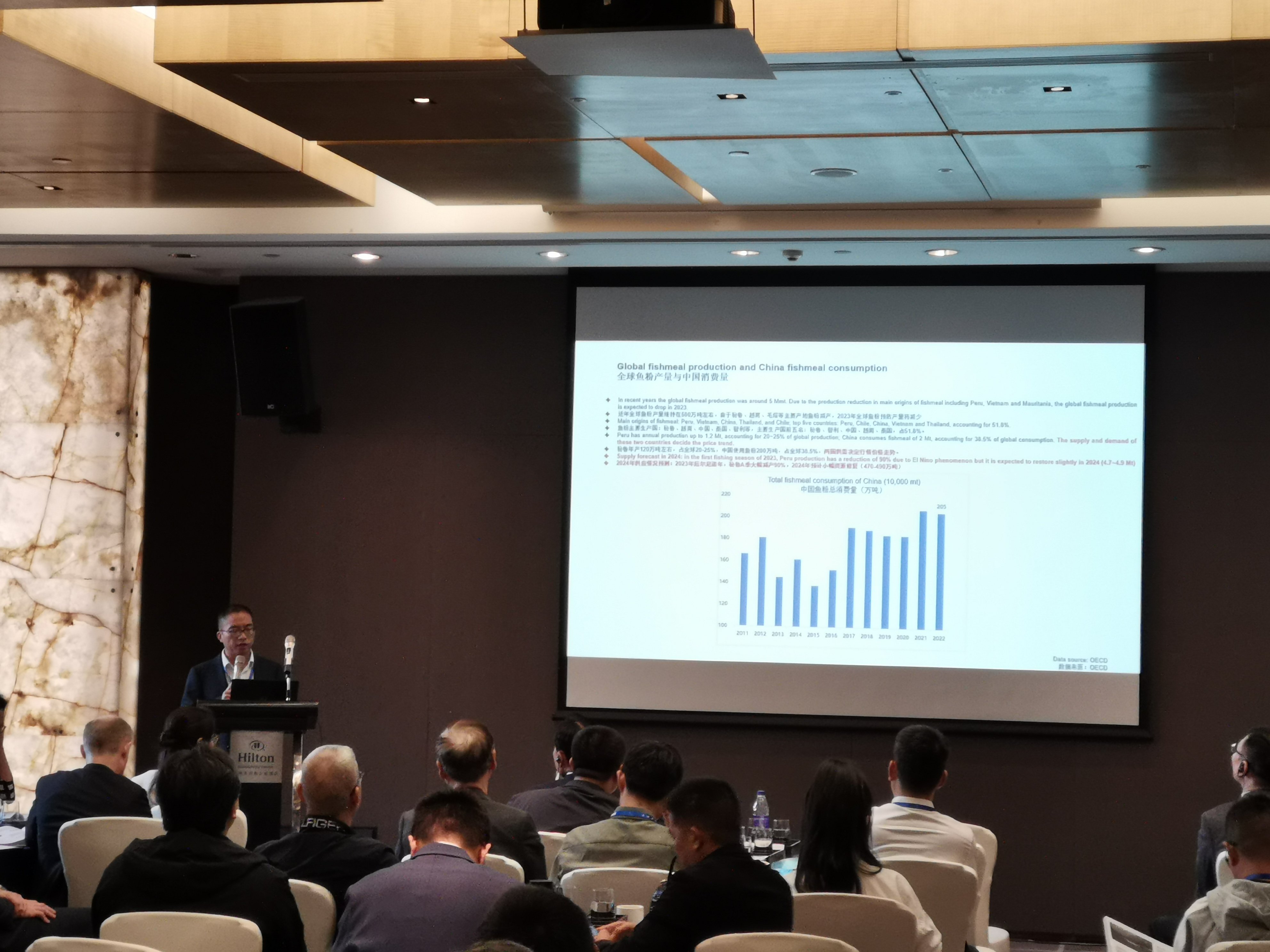

Marine ingredients: an overview on supply and demand

Continuing with the supply side discussions, IFFO’s China Market Analyst Henry Qu presented an update on the current trends in the global supply and demand of marine ingredients. A summary of the 2022 worldwide production of marine ingredients showcased the industry's resilience within the complex global landscape. With slightly over 5.3 million metric tonnes of fishmeal and nearly 1.3 million metric tonnes of fish oil, the production in 2022 remained consistent with the previous years. Notably, Qu emphasized that approximately 34% of the raw materials used globally are derived from by-products, underscoring the sector's ability to optimize valuable resources.

Looking at the demand for both fishmeal and fish oil, Qu underscored the critical role of marine ingredients in providing essential omega-3 fatty acids to humans. It is noteworthy that Asia and China contribute to nearly 85% of the globally farmed species. These regions also consume 70% of the fishmeal utilized in aquaculture, and further account for 25% of the fish oil used in aquafeed. Lastly, Qu delved into the significance of land animal farming and the expanding pet food sector. The rapidly growing dry pet food industry is increasingly incorporating marine ingredients into premium dry pet food, with inclusion rates of fishmeal ranging from 1 to 2%.

Vietnam fishmeal supply and demand trends

Providing an update on fishmeal and fish oil production and consumption in Vietnam, Ngo Nha Truc, the Deputy manager at IFFO Member Kanematsu Vietnam Co., LTD, noted that the country is one of the main producers in the region. Fishmeal production has decreased by 6% compared to last year, with pangasius production remaining consistent but fishmeal from wild caught fish has decreased due to fishing restrictions and the impact of climate change. The stability and increase of pangasius fishmeal have aided market stability. It now makes up 50% of fishmeal production. In terms of imports, China still dominates with 89% share of total export volume of fishmeal, followed by Cambodia, Japan, Korea and Thailand.

Moving to fish oil, again the market is dominated by pangasius oil, with imported fish oil to Vietnam reducing a lot due to high prices, with demand outstripping supply. In terms of exports, leading countries that Vietnam exports fish oil include the USA, Singapore, China and Malaysia. The demand in the USA is for pangasius fish oil which is used for biodiesel.

Update on the European marine ingredients industry

Moving to the European market, James Hinchcliffe, from EFFOP (European Fishmeal and Fish oil Producers), presented the latest data from the EFFOP members. With members representing factories across 13 European nation, Hinchcliffe noted that the European industry sources from pelagic mid-water trawl and purse sein fishing fisheries, with major parts of the fisheries and plants being certified by MSC and MarinTrust. Production of fishmeal and fish oil has remained stable, with increasing use of trimmings (38% of fishmeal in 2022).

The major European stocks used for fishmeal and fish oil are blue whiting, capelin, sprat, sand eel, and Norway pout. For trimmings the main species are herring, mackerel, whitefish, and aquaculture by-products. All these stocks have strict catch limitations, with total allowable catches (TACs) based on biological advice and under governmental regulation and control, using the principle of maximum sustainable yield (MSY). These quotas are set by individual countries (Norway, Iceland, Faroe Islands, UK, Russia, Greenland) or by groups of countries (European Union). These are agreed through annual bilateral and tri-lateral agreements, with the TACs for shared stocks and mutual exchange of fishing rights (i.e. EU-Norway, EU-UK-Norway). In annual multilateral agreements for straddling and shared stocks, done through Coastal state agreements and The Northeast Atlantic Fisheries Commission (NEAFC). The International Council for the Exploration of the Sea (ICES) provides information on stock status and trends and advice on fishery management for Northeast Atlantic and Baltic Sea fisheries. ICES supply advice for individual stocks based on peer-reviewed expert group reports, prepared in an advice drafting group and approved by the Advisory Committee (ACOM).

Marine ingredient supply and demand, Russia

Yuri Satskiy, the China based President of Sales at IFFO Member Norebo Group, provided an overview of his company’s key focus areas. Russian fishmeal and fish oil production sources mostly from the Barents Sea, the Norwegian Sea, the Faroe Islands EEZ, Porcupine (West of Ireland), Morocco and Mauritania, and the South Pacific. Highlights include the production of frozen products being conducted within 6 hours after harvesting to guarantee quality. Satiskiy provided an overview of each region, noting that locally there is high domestic demand for fishmeal and fish oil, with main exporting countries from the North Pacific region being China and South Asian countries.

Chilean marine ingredient supply and demand

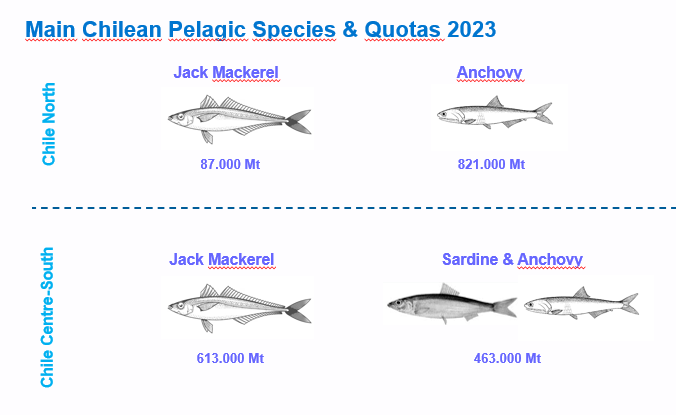

For Chile, Francisco Ovalle, from IFFO Member Orizon Smart Nutrition, noted that Chile is now the second fishmeal and fish oil producer worldwide and the world leading producer of Jack Mackerel. “Following 10 years of good fisheries management, stocks have moved from being overexploitation to maximum sustainable performance of its main pelagic fisheries (jack mackerel, sardine & anchovy), with certifications under MSC and MarinTrust” he stated. With more than 2 million Mt of total quotas, Chile can offer a quite stable volume of approximately 350.000 Mt of FM and 150.000 Mt of fish oil in average along the years. Regarding the main exports markets, China is the most important country for fishmeal with around 100.000Mt, mainly Prime and Super Prime quality. For fish oil, Europe is the main exporter, with 18-24% EPA+DHA mainly coming from the South of Chile. The EPA+DHA from the North of Chile is higher than South, reaching values around 27-30%.

“Regarding Jack Mackerel, Chile is a key member of the South Pacific Regional Fisheries Management Organisation, an inter-governmental organisation that is committed to the long-term conservation and sustainable use of the fishery resources of the South Pacific Ocean” he explained. With its own quota of 66%, plus the quota bought to other members, Chile got around 72% of the total quota this 2023, with a very clear aim to favour direct human consumption. The salmon industry is also dominant in Chile, as the second largest producer worldwide with exports of more than USD 6,5 billions. The salmon feed industry remains strong, but fishmeal and fish oil inclusion rates are dropping. Finally, expected revisions to the Fishing Law next year will likely put pressure on the split between industrial vs artisanal sector, auction systems, and larger protected areas among other topics.

Usage change of China fishmeal

Back to China, Huang Lun, the Animal Protein Purchasing Director from Tongwei Agricultural Development Co., Ltd noted: “Due to the reduction of Peru’s fishmeal production, the total supply is decreased by 300,000~400,000t. With the rapid development of special feed in China, the use of fishmeal has been improved quickly, resulting in gradual price rise of China fishmeal. Especially in 2023, the price fluctuation of China fishmeal exceeds 15,000 Yuan/t. In future, Chinese special feed will continue development and the use of fishmeal is expected to increase continuously”. However, with the large-scale farming, the formula proportion will decrease to balance the overall supply of fishmeal. In addition, high cost will also result in competitiveness decline and insolvency of farming enterprises and feed enterprises as well as rapid industrial integration.

Update on regulations

Presentations also included the latest regulations and inspection requirements for fishmeal and fish oil in China, with Fang Jun, the Deputy Secretary-general of the China Entry-Exit Inspection and Quarantine Association & China International Travel Healthcare Association. Fang provided an overview of the entry inspection and quarantine basis of fishmeal and fish oil in China, covering the risk rating and regulation pattern when it is imported as feed and feed additive. He provided a practical overview on the entry inspection and quarantine process of fish oil and fishmeal, including quarantine access, product quarantine and sanitation requirement, and registration of overseas manufacturing enterprise.