The third day of IFFO’s Annual Conference featured presentations and discussions on the global demands and complexities of marine ingredients, omega-3 markets and role in human health.

Marine ingredients update

IFFO’s Market Research Director Enrico Bachis set the scene with a review global demand trends for fishmeal and fish oil with IFFO’s estimates for 2024. Fishmeal exports in 2024 were higher than in 2023, with Peru’s exports returning to higher levels (26%) with increased production followed by Scandinavia, Chile and India. China once again led fishmeal imports with 48%, followed by Norway, Japan and Turkey. In terms of use, the aquaculture industry used 91% in 2024, similar to the previous years, as is the species consumption breakdown, with the largest fed aquaculture species being cyprinids (carps) at 41%, followed by crustaceans and other freshwater fish. Consumption of fishmeal in the pig sector as with poultry, which is mostly in China is reducing as fishmeal is being used more strategically, with consumption moving to aquaculture instead.

Fed aquaculture continues to grow, in 2024 reaching 73.75 million MT and China is producing 46% of the total production, followed by Asia (39%) and Latin America. In terms of the consumption of fishmeal by species, crustaceans appear to be consuming 25% of the total fishmeal destined to the aquafeed segment, down from 29% in 2023. Marine fish and fresh water species reported an year-on-year increased participation to the overall consumption, while salmonids lost some ground. Dry petfood supply has increased by 8% from 2024 to 2023, with an inclusion rate of fishmeal between 0%-1.5%.

Fish oil, production and therefore exports of fish oil didn’t increase in 2024, with the largest exporting countries remaining the same with Vietnam, Denmark, and Norway leading the ranking. World fish oil imports did not rebound in 2024 remaining short of 1 million MT, but the country breakdown remained the same apart from a slight increase in China. Consumption by segments, aquafeed is estimated to have consumed 63% and direct human consumption consuming 17%, while the leading consumers by fed aquaculture species, salmonids once again leads with 59%, followed by marine fish. Direct human consumption is estimated to have grown by 2% between 2023 and 2024, with leading consuming regions being North America (36%) and Asia (25%).

Japanese market trends

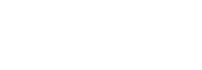

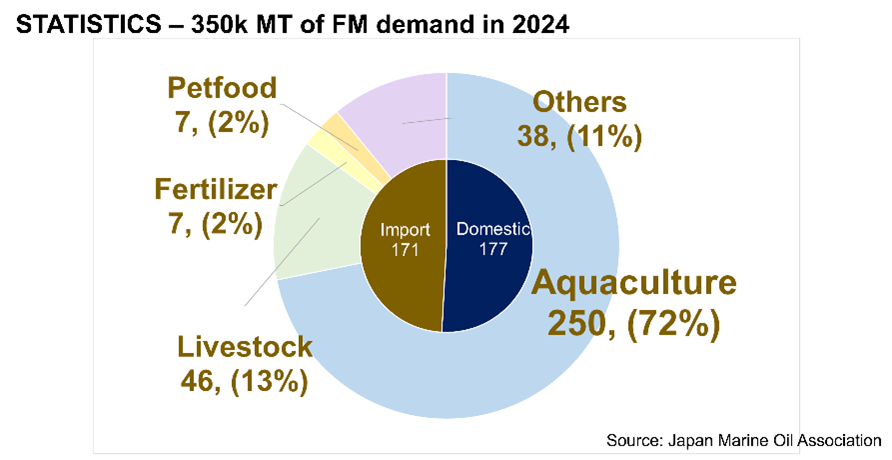

Moving to the Japanese market, Hikaru Kondo, a trader in the Protein Meal and NGFI Section for Kanematsu, presented the statistical demand and aquaculture realities of the Japanese market, highlighting emerging preferences and growth trends.

Kondo noted that demand for fishmeal in Japan has remained steady for the large 10 years and is largely from aquaculture (72%), followed by livestock (13%) in 2024, with average total demand of around 350 K MT and is expected to increase. While imports have largely been from South America/Peru (35%), there is emerging growth in imports from India and Oman, Peru’s fishmeal provides the density that is preferred by Japanese feed formulators. For fish oil, Kondo noted domestic production is high and that feed again is the dominant market in Japan (71%), followed by direct human consumption (omega-3) at 9% in 2024. For import markets, Chile dominates this area (75%) with salmon oil which meets local certification demands. The production of Japanese Sardine Oil is increasing, both in terms of volume and value.

The main farmed species in Japan are Yellow Tail, Red Sea Bream, Japanese Eel, and Coho Salmon, with varying fishmeal and fish oil inclusion rates but Japanese Eel having the highest for fishmeal inclusion and yellow tail the highest consumer of fish oil. He concluded by noting that demand for marine ingredients will likely continue to grow, with general transition from live bait to aquafeed.

Status of Asian shrimp aquaculture

Moving to the shrimp sector in Asia, Dr Olivier Decamp, R&D Director and Business Development Director for Health at INVE Aquaculture, stated that Global shrimp production, dominated by P. vannamei, continues to grow despite challenges. While Asia saw it’s first annual decline in shrimp production (2023-24), caused by rising feed costs, disease outbreaks, and shifting trade policies, there are now signs of recovery signs in countries such as India and Vietnam, with the latter investing in technology. Ecuador has seen increasing growth over the last 5 years, with other leading producing including China and India.

Decamp explored the challenges facing the industry, such as antibiotic use (predominately an issue in Asia), continuing rises in aquafeed costs and expected impacts from the US tariffs going forward. To remain resilient and competitive, he recommended that Asian producers must reassess farming methods and harvest targets, and improve sustainability through the implementation of certified, traceable, region-specific practices and new technologies throughout the production cycle, as seen in Ecuador. He concluded that “the industry needs to improve efficiencies in a sustainable way and farmers need to invest in early nutrition as part of cost benefit and disease prevention”.

Demand continues to grow in China

IFFO’s China Director Maggie Xu then presented her market update, noting that price reversion and decreased profitability have slowed down domestic marine ingredients production in China since 2024. Restricted availability of raw material whole fish has further reduced domestic output, with reduced catches. However, tilapia processing volume continues to be stable at around 520,000 mt and the market for tilapia filets have diversified, ensuring stability in by-products. By-products now account for 29% of fishmeal production. There was a sharp decline of imported sardines as raw material for marine ingredients production to an estimated 10,000 mt (2025).

For fish oil, by-products dominate production with 47%, but there was a general decrease in 2024 in production and export. For imports, Peru dominates both fishmeal (52%) and fish oil (45.8%) imports to China, with Russia imports reducing from 2023. Fish oil imports have been growing substantially too, following the price drop and rising demand by human consumption as well as pet food sectors. The decline in profits and prices led to clear reduction in feed grade fish oil export this year by China. Overall fish oil exports in 2025 may see a downturn, but fish oil consumption in 2025 is expected to grow in both feed and human consumption segments following the price retreats.

China’s aquaculture continues to grow, according to the Ministry of Agriculture, the cumulative aquaculture output Jan to Aug 2025 was 3.66 million MT, up by 4.6% YoY. While offshore aquaculture showed great potential in the first quarter, it is facing challenges such as from high investment requirements and the use outdated technology. Looking forward, demand of marine ingredients is expected to increase with the growth of China’s aquaculture industry, and although inclusion rates in pig feed are reducing, a substantial rise in newborn piglets in 2025, will also drive future demand.

In terms of regulations, Xu highlight a change in MOA license, with a new MARA requirement on the names of manufacturer, applicant company and product in Chinese characters on the Feed and Feed Additive Registration License(i.e., MOA license).

International shipping: investing to reduce risk

Providing an analyses on global supply chains, Thue Barfod, Global Director of the Fish and Seafood Vertical at A.P. Moller-Maersk, stated that while “disruption has always been part of supply chain life, we are currently facing the most disrupted business landscape in a generation. As business and politics grow increasingly intertwined, decisions made in one region quickly reverberate worldwide”. Barfod added that impacts are now happening more frequently, with wars changing trade routes, human error disruption and increasing uncertainty with trade tariffs, all of which increases shipping costs.

Barfod noted that Maersk has invested in engineering, digital, analytical and service expertise, plus deep customer insights to build their ocean network to deliver reliability, global reach and speed via efficiency and optimisation. Additional new gate way ports is also increasing efficiency, with an ecosystem of trade lanes and transhipment hubs to ensure the flow of goods, redirection around the Cape of Good Hope has added to shipping costs but has reduced risk and improved trade arrivals.

How IFFO drives systemic change

IFFO’s Technical Director Dr Brett Glencross and Communications Director Véronique Jamin presented an overview of how technical research and communications work hand in hand. Jamin opened by noting that over the past decade there has been a shifting narrative from focus on a traditional approach to feed ingredients, to now a focus on responsible sourcing. IFFO’s role in the Global Roundtable on Marine Ingredients has helped drive positive change, bringing stakeholders together to address environmental and social challenges in key fisheries. In Mauritania and Senegal, the Roundtable has commissioned a Track the Fish report, analysing the human rights impacts that the industry is having, carried out by Partner Africa. Workshops have been key to driving progress, held in Mauritania and Ghana. The Roundtable is now calling for countries from the region to coordinate on shared stock management.

The Asia workstream’s focus is to increase availability of globally recognised marine ingredients to comply with global feed standards’ requirements: fishery improvement projects are underway in India, Thailand and Vietnam but their ongoing work needs to be amplified; furthermore, no marine ingredients facility in India can claim a MarinTrust certificate for responsible sourcing, traceability and production. The Global Roundtable on Marine Ingredients will soon launch a socio-economic study to better understand the marine ingredients landscape in India and barriers slowing down the uptake of certification.

Looking beyond carbon footprint

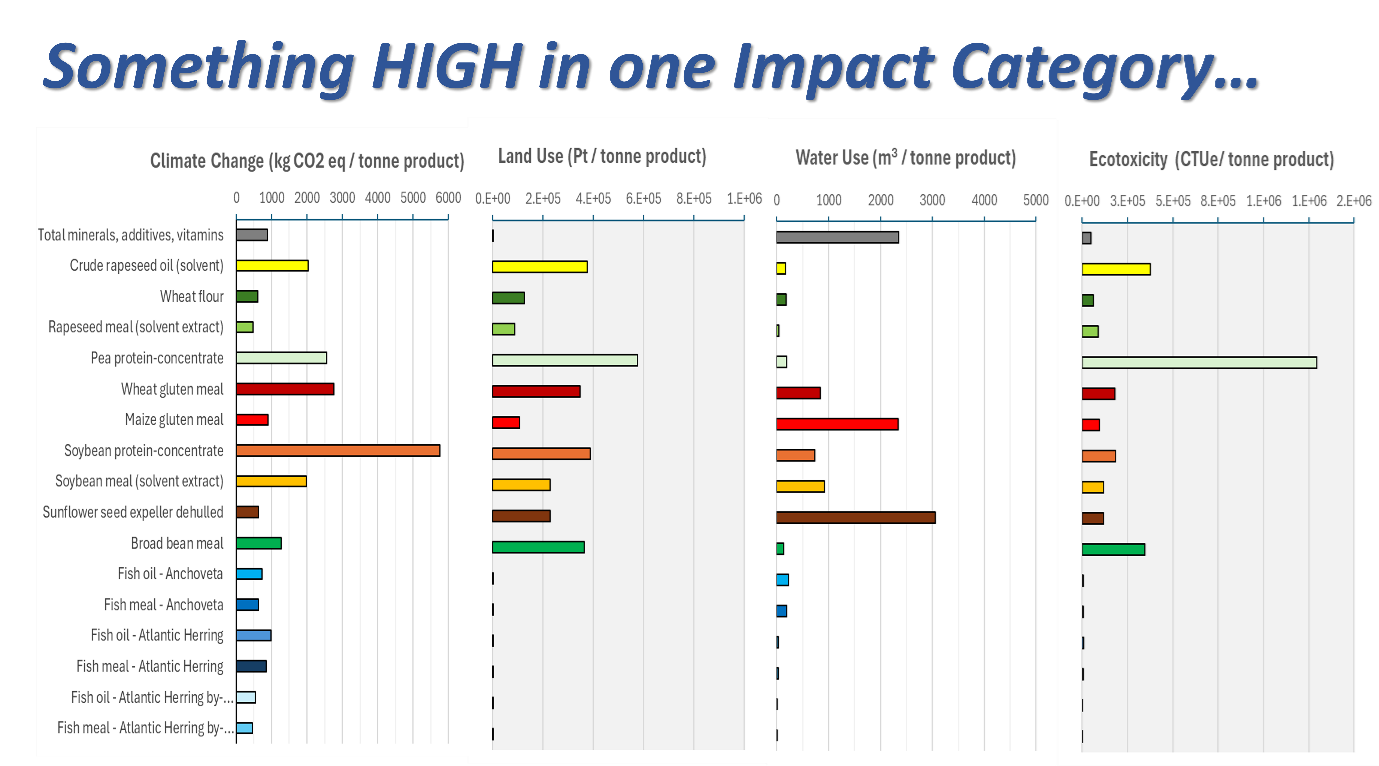

Discussing Life Cycle Impact Assessment, Glencross stated that “We need to move toward a more transparent assessment process as this will better support aquaculture to move forward by being able to assess the sustainability of the use of all feed ingredient resources on an equivalent basis.” He provided an overview of IFFO’s work with Global Feed Lifecycle Assessment Institute (GFLI) with their Life Cycle Assessment (LCA) database, a globally accessible, evolving animal feed ingredient database to support compliant, credible, and transparent environmental assessment of animal feed ingredients. Everything has a footprint somewhere and marine ingredients perform well mostly across the dataset.

Environmental impacts do not just occur on the production unit, they need to be tracked from raw material extraction (capture), processing, distribution, consumption/use, and waste disposal. Defining the extent (boundaries) of a system is critical, and IFFO has focused on a CRADLE-to-GATE (when it leaves ownership of producers) analysis of marine ingredient production. Glencross noted that IFFO has mapped six different system boundaries and flows, due to the range of production flows, such as direct human consumption processing and then the use of the remaining by-products, which can involve secondary transfers for rendering. The challenge was to standardize the data in these different systems to 1 tonne of fish to ensure the data is usable.

IFFO has created a primary data collection excel template for companies to then use, covering key data elements across three systems: processing, rendering, external storage, and transportation between them. This data is then fed into Simapro, allowing companies to map not just carbon foodprint, but also land use, ozone depletion, water use or even ecotoxicity, helping broaden the discussion on various ingredients. So far IFFO has collected 53 different product data sets across the global industry, comprising of 13 different types of fishmeals and fish oils. Reports detailing the footprint of each product have already been delivered to all participants who have provided data. IFFO’s currently working with GFLI to progress the audit stage to update the Database in 2026. Glencross ended by saying there is still more work to do: “We always need more data!”

An interactive survey was run at the end of the presentation about the use of byproducts in business activities. According to most of the respondents, by-products are either a core part of their operations or used occasionally. The following survey looked into emerging trends believed by the audience to most likely impact the marine ingredients sector in the next 5 years. A majority of the respondents cited regulatory changes and consumer demand for sustainability and traceability over other options such as precision nutrition, digitalisation and data-driven supply chains and additional ingredients.

Fish oil & Omega-3 markets

Looking at fish oil markets, Christian Meinich from Ch. Holtermann stated that markets have returned relatively back to normal after the impacts of El Ninõ in 2023/2024, but prices may increase in reaction to reduced quotas in Europe. The two-tier feed market of certified vs. non-certified oils remains in place but with reduced price gap at lower levels. There has been some predicted growth in demand, as well as in the supply of alternative sources of EPA and DHA. On the other hand, fish oils have produced sub-optimal fatty acid profiles both for the Omega3- and feed segments. This can to some extent be explained by natural fluctuations, but also in part reflect a backdrop of diverging growth developments between different species and global supply regions over the last years. Meinich concluded, that “with this backdrop, combined with a collective memory of considerable price fluctuations over the last years, the markets are now turning focus to the upcoming season in Peru with a cautious approach”.

Looking at fish oil markets, Christian Meinich from Ch. Holtermann stated that markets have returned relatively back to normal after the impacts of El Ninõ in 2023/2024, but prices may increase in reaction to reduced quotas in Europe. The two-tier feed market of certified vs. non-certified oils remains in place but with reduced price gap at lower levels. There has been some predicted growth in demand, as well as in the supply of alternative sources of EPA and DHA. On the other hand, fish oils have produced sub-optimal fatty acid profiles both for the Omega3- and feed segments. This can to some extent be explained by natural fluctuations, but also in part reflect a backdrop of diverging growth developments between different species and global supply regions over the last years. Meinich concluded, that “with this backdrop, combined with a collective memory of considerable price fluctuations over the last years, the markets are now turning focus to the upcoming season in Peru with a cautious approach”.

GOED’s Vice President of Data Science, Aldo Bernasconi noted “that global EPA and DHA omega-3 industry continues to be a diverse, thriving market with global reach and a variety of sources feeding into a robust category backed by solid science”. The omega-3 ingredient industry is extremely reliant on a single source, which creates risk when there are inevitable supply disruptions and this can only be mitigated by increasing new and existing sources. While overview omega-3 ingredient demand did grow by 2.4% in 2024, with the fastest growing region being China, less dependent on anchoveta oil and has a fast-growing petfood market.

Traditional 18/12 refined oils are being replaced by refined oils with a total of 30% omega-3, with less specific EPA to DHA ratios, which allows the industry some necessary flexibility. In the US, reduced crude oil supply and record fish oil prices in 2023 and 2024 resulted in increased reliance on alternative sources, changes in production practices and in the formulation of products sold. On tariffs Bernasconi noted that consumer interest doesn’t appear have been impacted so far, but they will likely impact who sells to whole and what products are on the market. In recent years, inflation has not slowed global demand, but continued inflation and economic uncertainty may make consumers less willing to make non-essential purchases.

New methods to understand the role of Omega-3s

Looking to human health, Professor Richard P. Bazinet, Professor (Department of Nutritional Sciences, University of Toronto) presented his latest research on Docosahexaenoic acid (DHA), looking at markers in the human brain to determine how much is needed and how the body processes it. In addition to obtaining DHA from fish, it can be synthesized in the liver from alpha‑linolenic acid (ALA), an 18‑carbon omega‑3 fatty acid that serves as a precursor. Bazinet added that it was recently found that dietary DHA can inhibit its own production from ALA. Building on this finding, a DHA dose‑response study was carried out in people who do not routinely consume DHA to identify the dose at which DHA begins to suppress its own synthesis from ALA—a potential marker of the amount of DHA that is needed. Bazinet concluded that the study showed that the adult brain has about 3.5 g of DHA and uptakes about 3.5 mg of DHA per day, and that DHA intake leads to an increase in EPA not just by retroconversion, but by inhibiting EPA elongation. DHA increases EPA levels at about ~220 mg/day, which could be a good marker for how much DHA we need.

Discussions show a shifting narrative

Closing the conference, IFFO’s Director General Petter Johannessen summarized that “a recurring theme throughout our discussions has been the vital role of industry in supporting governmental efforts to implement effective fishery management measures. This aligns closely with IFFO’s long-standing commitment to responsible practices, and it is encouraging to see a growing consensus around the need for collaboration.

The narrative is indeed shifting. There is a clear recognition that addressing the global food challenge requires all of us—across sectors and geographies—to work together. Every feed ingredient has a role to play, and it is through realism and pragmatism that we will shape the sustainable food systems of tomorrow.”