IFFO Conference 2025: Key takeaways from the Opening session (20 October)

IFFO – The Marine Ingredients Organisation is holding its Annual Conference in Tokyo, Japan, from the 20th to 22nd October. Open to IFFO Members and non-IFFO Members interested in the marine ingredients value chain, the conference has gathering together 518 delegates from 46 countries. The programme features 23 speakers providing an unparalleled global outlook exploring feed ingredient strategies, supply and demand for marine ingredients, and country and regional market updates.

IFFO’s President, Egil Magne Haugstad, opened the conference and welcomed delegates from across the world, with an impressive balanced representation from across all regions. He highlighted some of IFFO key achievements, including a range of events, peer-reviewed research papers, online campaigns and a whole resource of infographics detailing the marine ingredients story.

Aquaculture is thriving in Japan

Director General, Fisheries Agency, Government of Japan, Mr. Hitoshi Fujita welcomed delegates and presented Japan’s fisheries strategy. Fujita commended IFFO’s efforts to ensure transparency within the industry, strength and cooperation, while promoting resource sustainability and encouraging the use of by-products. He noted that nutrition from aquaculture production is critical to global food issues and aquafeed is central to this, with IFFO’s role becoming significant in years ahead. Japan is both an importer and producer of marine ingredients, with 70% coming from by-products, to ensure the country’s resources are sustainably used.

Aquaculture is thriving in Japan and has been targeted as a growth sector, with the industry being valued at 3.8 billion USD. Feed is indispensable as part of this, and Japan is striving to improve feed efficiency and ensuring stable supply. But challenges do remain with the sustainable use of natural resources and environmental and socio-economic issues. Fujita concluded by stating that as “global demand continues to grow, Japan is investing in land-based aquaculture and IFFO’s effort to promote industry cooperation, ensuring transparency and establishing standards for responsible supply are crucial for addressing these issues.”

Role of marine ingredients

IFFO’s Director General, Petter Johannessen continued the marine ingredients story, noting that “at the heart of our industry are small pelagic fish species. These fish are not only abundant and fast-growing but also highly seasonal and perishable. When not consumed fresh, they can be canned or frozen and the surplus is quickly processed into marine ingredients to preserve their nutritional value and keep these vital nutrients within the food chain. Their high digestibility, palatability and nutrient density make them valuable in aquaculture, where feed intake is a critical factor in fish health and growth, and in nutraceuticals where omega-3s are highly sought after. Helping fisheries improve where needed, and contributing to ecosystem management, through biomass monitoring which informs quota settings, is therefore part of IFFO’s mission. We need to be part of the solution for shaping the responsible future of our global food system.”

Between the superpowers

Setting the scene Robin Harding, the Asia Editor for the Financial Times, explored the current complex geopolitical tensions and the impacts on business and trade. Harding explored the change and rise of China’s production from less advanced goods to an additional and growing focus on advanced goods, making it the industry powerhouse. Whereas the United States has become the dominant superpower for finance and technology, and the relationship between the US and China is being mostly driven by the US trade deficit and China’s surplus. Harding concluded that the tariffs are a response to this imbalance and a large portion of the announced tariffs from the US have not come into effect yet. He predicted that these tariffs are unlikely to greatly impact the trade imbalance or the global economy, with China’s exports falling to the US, but diverted to through countries instead and exported onto the US. Two separate ecosystems will continue to develop between the two countries, but this will happen in parallel to the thriving international trade system, and the fishing industry shouldn’t be negatively impacted. He added that population growth or decline is directly related to a country’s GDP, potentially impacting the future economic growth for China and other South East Asia countries.

Meeting global fish demands

FAO’s Manuel Barange moved discussions onto the state of global marine fisheries resources and future expectations. Barange presented the latest data on production and consumption trends, noting that aquatic animal proteins have seen the greatest growth in consumption of 2.25% (2010-2023) compared to other proteins, which is twice the rate of population growth.

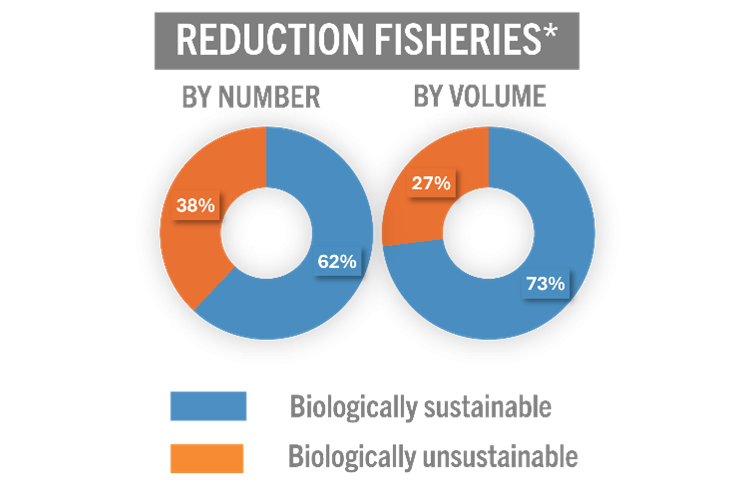

He added that fed aquaculture production is outpacing capture fisheries for reduction, largely due to evolving feed formulations. On the sustainability of reduction fisheries, Barange detailed a regional breakdown and showed that overall 73% of the total volume landed is biological sustainable (see graph). To increase this further, there needs to be improvements in fisheries data collection systems, stocks assessments, and management systems. He added that combining sustainability indicators and production trends helps identify the hotspots of concern. He identified flashpoints from the FAO data, that show current trends for potential deteriorating sustainability indicators in areas such as West Africa and South and South East Asia.

Barange concluded that “to be part of the solution, the private sector must ensure that governments and regional organisations adopt management measures where they operate”. This is especially important with the growing impacts on climate change, reducing productivity and availability. Looking forward, growth is expected in aquaculture, increasing by 20% from 2024-2034, with aquatic food consumption per capita to grow everywhere except Europe (marginally down) and Sub-Saharan Africa. “We need to keep running and carry on transforming the sector to keep up with demand, blue transformation is key to this.”

Source: FAO 2021

Moving focus to business, Darian McBain, CEO of Outsourced Chief Sustainability Officer Asia, challenged the current norms of who is responsible for responsible production. McBain opened by highlighting that just 1% of global climate finance goes to ocean-based solutions, while the ocean absorbs over 90% of excess heat from global warming, supports the livelihoods of 3+ billion people— and yet remains vastly unvalued and underfunded.

McBain summarised that “the lack of investment in the ocean is self-evident and truly concerning. Of all the Sustainable Development Goals, SDG 14 on the ocean is by far the least funded, representing a minuscule 0.01% of all SDG funding from development finance up to 2019, and only 0.56% of all philanthropic funding since 2016. Even the crucial link between ocean and climate is massively undervalued, judging by the allocation of international climate finance.”

She added that business needs to be part of the solution, but current sustainability reporting is often not linked to finance or core to a company’s strategy. Sustainability disclosure standards need to be harmonised to create reliable and comparable ESG data and disclosures. This is becoming increasingly critical to attract capital and investors and prevent greenwashing. A welcoming step in the convergence of different standards and frameworks are the new sustainability and climate-reporting standards by the IFRS Foundation and the European Sustainability Reporting Standards. The reliance on nature and the growing challenges that companies face is driving an increase in responsibility, she concluded that “nature is a public good and service, but a shared responsibility”.

Navigating complexity

Speakers then joined a panel discussion on navigating complexity, led by global seafood journalist Drew Cherry, he started with a focus on areas of growth in Asia. Robin Harding (FT) highlighted that outside China, Vietnam is seeing increasing growth, with Bangladesh and India’s population growth driving economic growth, there are huge opportunities for business across Asia, including in seafood.

Barange addressed the evolving role of the UN, technical agencies such as the FAO operate separately in terms of governing body and budget. However, the cancelling of US Aid has impacted FAO budgets, with over 100 projects cancelled, and other companies are not coming forward and some are reducing their budgets. US influence is large, but the FAO is working to continuing its mandate without political disruption. “The whole landscape has changed. It is more about partnerships and development aid”, he noted.

McBain addressed the changing perception of public leadership and outreach by seafood companies, with the public now demanding higher standards and transparency: “Companies need to step up, don’t practice greenhushing!” she said. “The question that we need to ask about sustainability is can you continue to do what you’re doing in the future, don’t be distracted by acronyms and instead think about how are you being responsible and how can you put it into practice.”

Cherry questioned the role of SDGs and why the seafood industry should care and integrate them into their business. Barange stated that companies have used SDGs and aspire to them but they are coming under threat. He added that it is likely that they will be extended beyond 2030 as they do provide aspirational pathways for the future. “We need to rethink sustainability, it is about the food systems as a whole and the trade-offs within it.”

In response, Harding noted that there is a problem with the perception of SDGs, there is so much content that it can be viewed as greenwashing, but while the wind is changing sustainability commitments still remain important for business.

Cherry highlighted the regions where unsustainable practices are occurring. Barange stated that sustainability failures do not have a single cause but multiple from regulation to monitoring, which cost money. “It is not about pointing figures at who is doing it wrong, but instead help build support systems. As business, if you are going to work in a particular area, ask what system is supporting the fishery’s quota system. We need to solve the problem of the world as a whole and not shy away from these challenging areas.” Barange highlighted the positive role of the Agreement on Port State Measures (PSMA), which gives power to countries to inspect visiting foreign fleets and now has 75% of the coastal states as signatories. This system has helped level the playing field in regions such as Africa. “Africa is investing in aquaculture at an incredible pace. Zambia is a great success story with a very intense private engagement”. McBain concluded that the industry needs to be part of continuous development and collaborative Fishery Improvement Projects (FIPs) are an important example of this. “People are turning to the blue economy. There is a void in which the seafood industry can step in.”